Advertisement

Advertisement

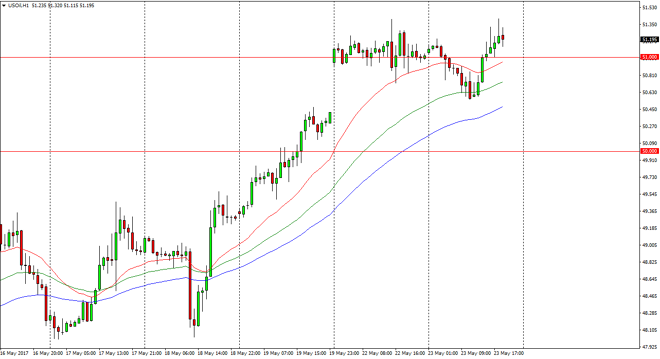

Crude Oil Price Forecast May 24, 2017, Technical Analysis

Updated: May 24, 2017, 03:44 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went back and forth during the day on Tuesday, dipping below the $51 level but finding enough support at the gap

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Tuesday, dipping below the $51 level but finding enough support at the gap from a couple of sessions ago to turn around and rally. The market breaking back above the $51 level is a good sign, so having said that I think that if we can break above the top of the range for the day that would be bullish. However, is very likely that the market will probably be quiet until the OPEC announcements coming out of the meeting on Thursday, so ultimately it’s difficult to imagine a situation where buying a large position can be done ahead of time. However, based upon the gap that we had seen a couple of sessions ago, it does suggested there is a proclivity of bullish pressure. The question now probably isn’t whether or not OPEC will announce further production cuts, but whether or not they will expand them. If they don’t, look out below.

Oil Forecast Video 24.5.17

Brent

Brent markets initially fell during the day but turned around to form a supportive candle and it looks as if Brent markets are willing to sit sell as well. It’s very difficult to trade this market going forward until we get that announcement, as it seems like the trading community is out there waiting to see what OPEC will do in general. I do think the longer-term we may have some issues when it comes to pricing in oil, but in the short term we are paying attention to OPEC, and as long as that’s the case, today could be very quiet and very difficult to make any money trading the petroleum markets. I believe that Friday will be when we see where the markets going next.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement