Advertisement

Advertisement

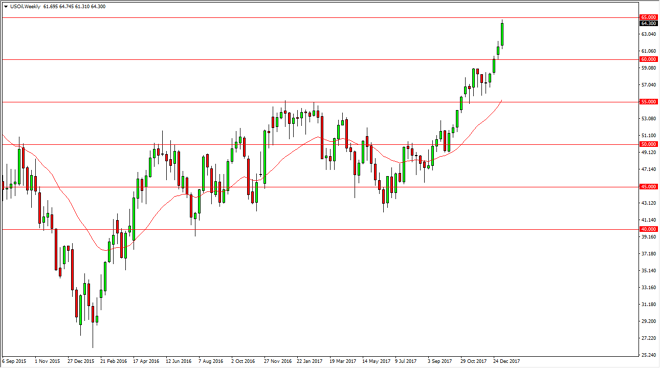

Crude Oil Price forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:06 GMT+00:00

The crude oil markets exploded during the week, reaching towards psychologically significant levels, and it’s likely that we will continue to see buyers, but we are getting a bit overextended.

WTI Crude Oil

The WTI Crude Oil market exploded to the upside during the course of the week, especially on Friday. It looks like we are going to test the $65 level above, which of course is an area that is psychologically important. We are bit overextended, so I think that a pullback is very possible. The $60 level underneath should be a bit of a “floor” in the market, so I don’t have any interest in trying to short this market, I think that the pullback will offer value the people are willing to take advantage of that deal with this market. Short-term traders might be willing to sell, but longer-term, buying is the only thing that you can do.

Crude Oil Inventories Video 15.01.18

Brent

Brent markets exploded to the upside, testing the $70 level. It’s likely that the market will continue to see a lot of noise, with the $65 level underneath being just as supportive as the $60 level in the WTI market I like the idea that buying dips offers, but if we do break above the $70 handle, it’s likely that we will get a bit of a blow off top. Ultimately, this is a market that I think gives us an opportunity to pick up dips, as it gives you an opportunity to find value. It’s obvious that the oil markets are starting to get a bit overheated, so be careful. The $65 level is massively supportive, so a breakdown below there would of course be very negative. In the meantime, I think buy on the dips is the mantra.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement