Advertisement

Advertisement

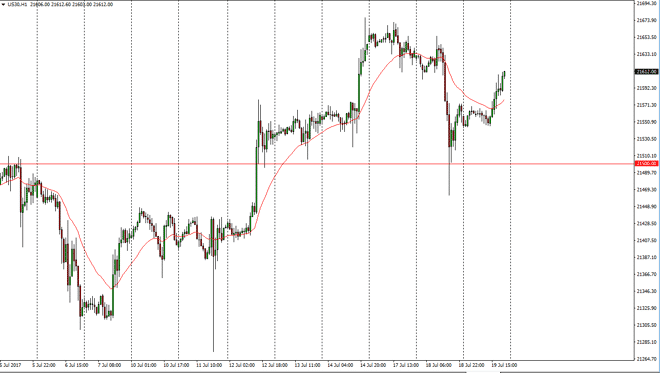

Dow Jones 30 and NASDAQ 100 Price Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:23 GMT+00:00

Dow Jones 30 The Dow Jones 30 went sideways initially during the day on Wednesday, but then shot higher once the Americans came back. Because of this,

Dow Jones 30

The Dow Jones 30 went sideways initially during the day on Wednesday, but then shot higher once the Americans came back. Because of this, looks like the Americans are ready to push the stock markets higher, and therefore I look at pullbacks as potential buying opportunities. Once we get those pullbacks, it’s likely that we will reach towards the 21,650 handle. A break above there should send the market to the 22,000 level. I think that the 21,500-level underneath should continue to be support, and essentially the “floor” in the market. Given enough time, I think that the market should show volatility, but upwards volatility more than anything else.

Dow Jones 30 and NASDAQ Index Video 20.7.17

NASDAQ 100

The NASDAQ 100 rally during the day on Wednesday, breaking above the vinyl 5900 level. Because of this, the market looks likely to continue to go towards the 6000 handle. The market pulling back from here should find support near the 5900 level, an area that had previously been resistance, which is classic technical analysis. I believe that the market eventually should go to the 6000-handle based upon my longer-term analysis and I think that market will be very difficult to break above. Once we do clear that area, I think the people will hang on to the NASDAQ 100 for the longer-term move. Selling is all but impossible, and I would not be interested in doing so until we break below the 5850 handle, something that looks very unlikely to happen anytime soon. Given enough time, I think that the buyers will assert their will yet again.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement