Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast May 30, 2017, Technical Analysis

Updated: May 30, 2017, 05:53 GMT+00:00

Dow Jones 30 The Dow Jones 30 was of course close for Memorial Day in the United States, but the underlying CFD market was available for trading. It did

Dow Jones 30

The Dow Jones 30 was of course close for Memorial Day in the United States, but the underlying CFD market was available for trading. It did almost nothing of course, so having said that it’s likely that the real move will happen today. We are close to the all-time highs, so it’s only a matter of time before we break out and reach towards the 21,500 level above there. A pullback from here should find massive support at the 21,000 handle, and I believe that we will continue to be in a “buy on the dips” type of market, as the Dow Jones 30 represents the blue-chip companies of the United States. The market continues to be one that I like, but it will be a slower moving index as far as the United States are concerned.

Dow Jones 30 and NASDAQ Index Video 30.5.17

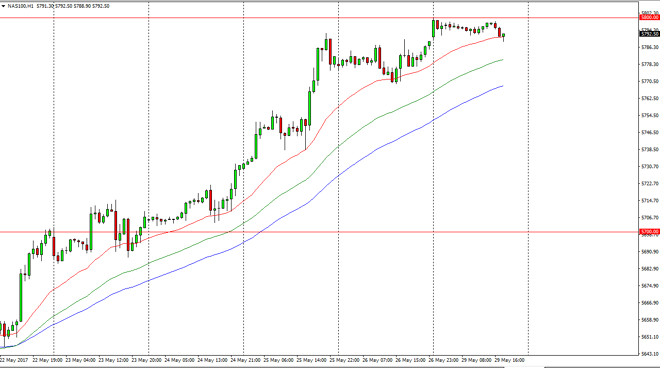

NASDAQ 100

The NASDAQ 100 of course was closed as well, and the CFD markets essentially went sideways. It looks as if the 5800 level above being broken to the upside should continue to send this market even higher. The 24-hour exponential moving average offered support, and I believe that it’s only a matter of time before we break out to the upside, and then reach towards the 5900 level above there. Longer-term, I believe that the market is probably going to the $6000 handle after that. I have no interest in shorting this market, I believe that the 5770-level underneath will offer a significant amount of support going forward, and will certainly be backed up underneath by the 5750 handle.

Breaking out above the 5800 level will more than likely happen during the session, and the NASDAQ 100 has not only been strong, but it has lifted the other US indices right along with it.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement