Advertisement

Advertisement

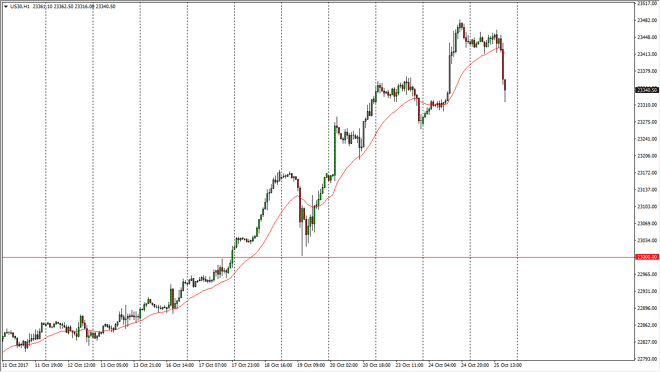

Dow Jones 30 and NASDAQ 100 Price Forecast October 26, 2017, Technical Analysis

Updated: Oct 26, 2017, 07:35 GMT+00:00

Dow Jones 30 The Dow Jones 30 rolled over rather drastically as US stock traders sold everything in sight. Quite frankly, this is a market that has been

Dow Jones 30

The Dow Jones 30 rolled over rather drastically as US stock traders sold everything in sight. Quite frankly, this is a market that has been overextended for some time, and thinking that we could continue the trajectory that we had seen over the last several weeks was a bit foolhardy. However, if you are patient enough you should see value in the market return, and I think that we could fall as low as 23,000 and still retain a very bullish attitude. Remember, the markets climb a wall of worry while falling like a knife. This is essentially what we’re seeing, hot and nervous money flowing out of the market. We are still very much in an uptrend, so I’m waiting for a sense of stability to return to the market, so I can take advantage of the new value, and start buying again.

Dow Jones 30 and NASDAQ Index Video 26.10.17

NASDAQ 100

The NASDAQ 100, of course, fell as well, slicing through the 6050 handle. This is a significant development, and what this tells me is that we may have a little bit of follow-through to the downside. However, I have absolutely no interest in trying to short this market, as I recognize the 6000-level underneath being massively supportive as it was massively resistive. Looking for some type of stability or supportive candle is what I am doing now, and I think I will get it over the next couple of days. Let the panic subside, and then pick up the cheap NASDAQ 100 is how I look at this market. If we were to break down significantly below 6000, that changes everything else, but right now I don’t think that’s going to happen as this move has been rather sudden, and typically those moves fade.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement