Advertisement

Advertisement

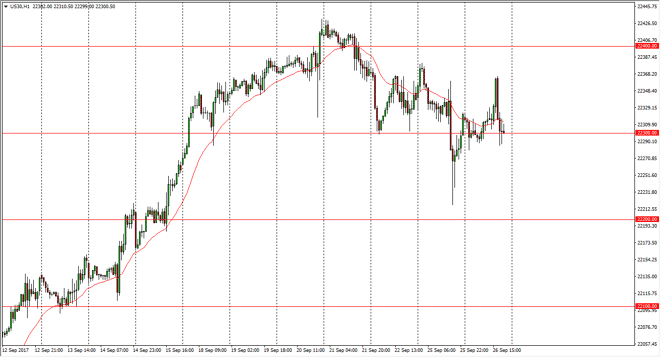

Dow Jones 30 and NASDAQ 100 Price Forecast September 27, 2017, Technical Analysis

Updated: Sep 27, 2017, 05:31 GMT+00:00

Dow Jones 30 The Dow Jones 30 had a very volatile session on Tuesday, breaking above the 22,300 level, but only to turn right back around and test that

Dow Jones 30

The Dow Jones 30 had a very volatile session on Tuesday, breaking above the 22,300 level, but only to turn right back around and test that level again. I think we continue to see a lot of choppiness in stock markets around the world as there are a lot of concerns and geopolitical headwinds out there to rock the markets. Ultimately, this is a market that I think will be difficult to deal with, and I would not blame you would offer standing on the sidelines over the next 24 hours, I need to see some type of clarity in the charge to start buying again, but certainly don’t have enough to start selling. Because of this, I remain flat until I get a daily candle that instills confidence in some type of direction.

Dow Jones 30 and NASDAQ Index Video 27.9.17

NASDAQ 100

The NASDAQ 100 fell during the week but found enough resistance at the 5900 level to keep the markets a bit soft. It’s not until we clear the 5900 level on a daily chart that I’m willing to buy. I’m not quite ready to start selling yet though, because I think there is quite a bit of bullish pressure underneath. The NASDAQ 100 has been the weakest of the major indices in the United States, and I think that Mike continue to be the case. I believe that this will be a laggard, but eventually, we should see some type of positivity given enough time. I don’t have any interest in trying to figure out what the noise is about, quite frankly there will be better trades if you are patient enough for the market to show its true intentions. Until then, it’s best to sit on the sidelines.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement