Advertisement

Advertisement

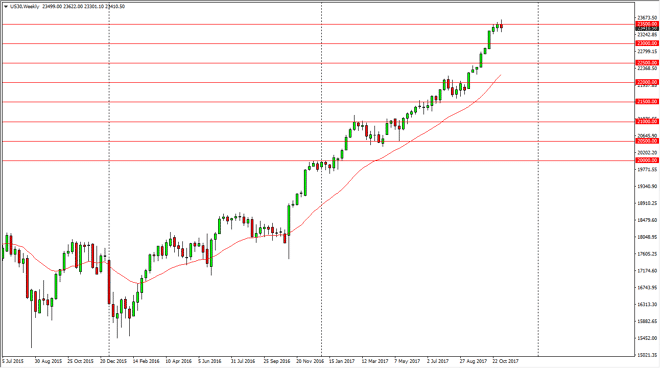

Dow Jones 30 and NASDAQ 100 Price Forecast for the Week of November 13, 2017, Technical Analysis

Updated: Nov 12, 2017, 08:19 GMT+00:00

Dow Jones 30 The Dow Jones 30 went back and forth during the week, as we struggled to break above the 23,500 level. Ultimately, I think that it’s likely

Dow Jones 30

The Dow Jones 30 went back and forth during the week, as we struggled to break above the 23,500 level. Ultimately, I think that it’s likely that we are going to pull back from here, as we have gotten a bit overextended. If we can break above the top of the candle, I think that the market could continue to go higher, but quite frankly this is a market that is a bit overextended. Ultimately, I think that pullbacks are nice buying opportunities and value. The Dow Jones 30 is a market that I would not be interested in selling, so I think that it’s likely that the value hunters will be looking. The 22,000-level underneath is the “floor” in the uptrend from what I see.

Dow Jones 31 and NASDAQ Index Video 13.11.17

NASDAQ 100

The NASDAQ 100 went back and forth, forming a neutral candle as well. It looks as if the 6300 level offers a significant amount of resistance, and I think that we could pull back a bit, perhaps even as low as 6000 if we get some type of value. The 6000 level is previous resistance, and it should now be supportive based upon the breakout. I think that market memory could come into play, but likely it’s going to only offer value that we can take advantage of. Alternately, if we can break above the top of the candle for the week, then we should go to the 6400 level. However, this is a market that has been overextended, and it makes sense that a pullback is needed to get fresh money into the market. With this being the case, and of course concerns about tax reform in the United States, we may rollback.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement