Advertisement

Advertisement

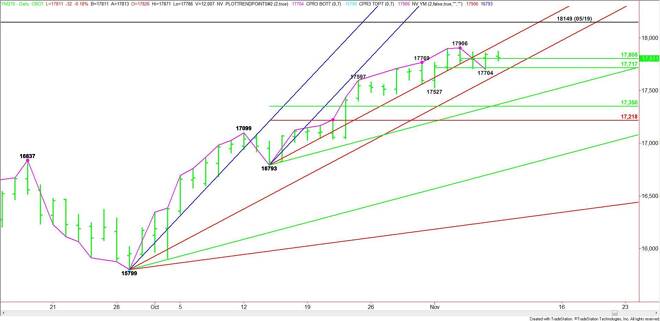

E-mini Dow Jones Industrial Average (YM) Futures Analysis – November 9, 2015 Forecast

By:

December E-mini Dow Jones Industrial Average futures are trading slightly lower shortly before the cash market opening. The market is currently playing in

December E-mini Dow Jones Industrial Average futures are trading slightly lower shortly before the cash market opening. The market is currently playing in a tight range, controlled by a pair of short-term pivot prices. At the same time, the price direction is being manipulated by investors who believe the economy is strong enough to sustain a further rally and those who believe that higher interest rates will send the market lower.

The main trend is up according to the daily swing chart. However, the two day break from 17906 to 17704 suggests momentum may be shifting to the downside.

Based on Friday’s close at 17843, the first key level to watch is a short-term pivot at 17805. The second key level is another short-term pivot at 17717. Trader reaction to these levels will set the tone for the day. Because they are so close, the Dow may even trade inside a 100 point range today. It all depends on how much buying volume and selling volume comes in today.

A sustained move over 17805 will indicate the presence of buyers. The first upside objective is the main top at 17906. Overtaking this top will signal a resumption of the uptrend.

The first upside target over 17906 is a steep uptrending angle at 17945. Crossing to the strong side of this angle will put the Dow in a bullish position. This could trigger an acceleration to the upside with the May 19 main top at 18149 a potential target.

A sustained move under 17805 will signal the presence of sellers. However, the break may stall at the next pivot at 17717. Crossing to the weak side of this pivot will mean the selling is getting stronger.

The first objective under 17717 is Friday’s low at 17704. This is followed closing by a long-term angle at 17655. This angle is important because it is the trigger point for a steep break into at least 17369 today.

If a new main range forms between 15799 and 17906 then the primary downside target becomes 17350 to 17218.

Watch the price action and order flow at 17805 and 17717 today. If you can put up with a choppy, two-sided trade over both these levels then you can expect a big payoff, especially to the downside.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement