Advertisement

Advertisement

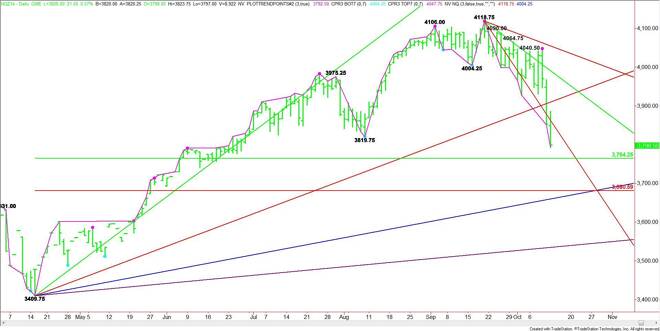

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 14, 2014 Forecast

By:

December E-mini NASDAQ-100 Index futures closed sharply lower on Monday and in a position to test a major retracement zone. Although the main trend is

December E-mini NASDAQ-100 Index futures closed sharply lower on Monday and in a position to test a major retracement zone. Although the main trend is down on the daily chart, there may be a technical bounce, following the first test of this zone so it is suggested that short-sellers have an exit strategy in place to avoid being caught in a bear trap.

The main range is 3409.75 to 4118.75. This makes its retracement zone at 3764.25 to 3680.50 the next likely downside target. Markets like to reverse inside these major retracement zones so watch for signs of bottoming action.

If the selling pressure proves too much for the retracement zone to handle then look for an extension of the break into the next major uptrending angle at 3535.75. The daily chart indicates there is plenty of room to the downside if this angle fails with the next angle coming in at 3472.75 today. This is the last major support angle before the April 15 main bottom at 3409.75.

The nearest resistance is a steep downtrending angle at 3846.75. Overtaking this angle will be the first sign of short-covering. The short-covering will get stronger if traders can overcome the nearest uptrending angle at 3661.75. Increased momentum through this angle could even trigger a rally into another downtrending angle at 3982.75.

The tone of the market is likely to be determined by trader reaction to the major 50% level at 3764.25 and then again at 3846.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement