Advertisement

Advertisement

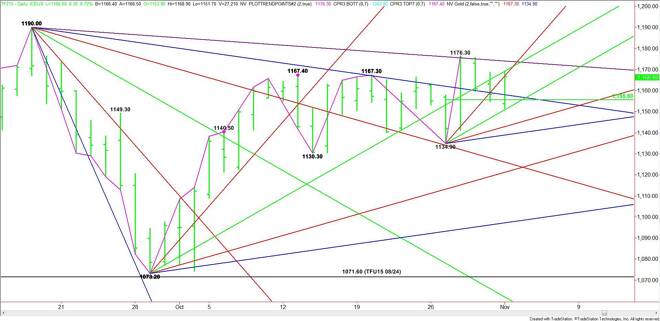

E-mini Russell 2000 Index (TF) Futures Technical Analysis – November 2, 2015 Forecast

By:

December E-mini Russell 2000 Index futures are trading higher after recovering from early session weakness. The main trend is up according to the daily

December E-mini Russell 2000 Index futures are trading higher after recovering from early session weakness. The main trend is up according to the daily swing chart, however, momentum appears to have shifted to the downside. This is most likely a move to correct overbought conditions and may not be signaling an imminent change in trend to down.

The short-term range is 1134.90 to 1176.30. Its 50% level or pivot level is 1155.60. This level is controlling the short-term direction of the market.

A sustained move over 1155.60 will signal the presence of buyers. The first Gann angle target is a long-term downtrending angle at 1138.90. This angle may act like resistance on the initial test, but keep in mind that it is also a trigger point for an upside breakout.

The next target over 1138.90 is a steep uptrending angle at 1166.90. Crossing to the strong side of this angle will put the index in a bullish position with a long-term angle at 1174.00 the next target. This is the last potential resistance angle before the 1176.30 main top.

Based on the current price at 1166.90, the direction of the market into the close is likely to be determined by trader reaction to the steep uptrending angle also at 1166.90.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement