Advertisement

Advertisement

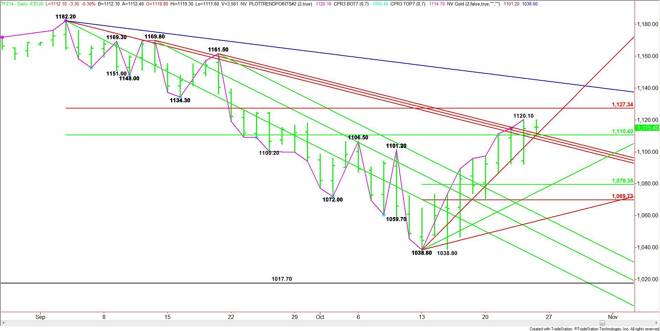

E-mini Russell 2000 Index (TF) Futures Technical Analysis – October 27, 2014 Forecast

By:

December E-mini S&P 500 Index futures posted an inside day on Friday, indicating trader indecision and impending volatility. It could also be an

December E-mini S&P 500 Index futures posted an inside day on Friday, indicating trader indecision and impending volatility. It could also be an indication the index is going through a transition period. This could mean a short-term top is forming.

The main range is 1182.20 to 1038.60. The retracement zone formed by this range is 1110.40 to 1127.30. Last week’s high at 1120.10 was inside this range.

Today’s session will open up with the index on the weak side of a steep uptrending angle at 1118.60. Overcoming this angle will be a sign of strength.

If sellers hit the market then look for them to try to drive the market under the 50% level at 1110.40. This is followed by a series of downtrending angles at 1109.50, 1107.80 and 1106.20.

The daily chart opens up under 1106.20. Potential downside targets include 1079.30 and 1078.60.

The tone of the market today will be determined by trader reaction to the 50% level at 1110.40.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement