Advertisement

Advertisement

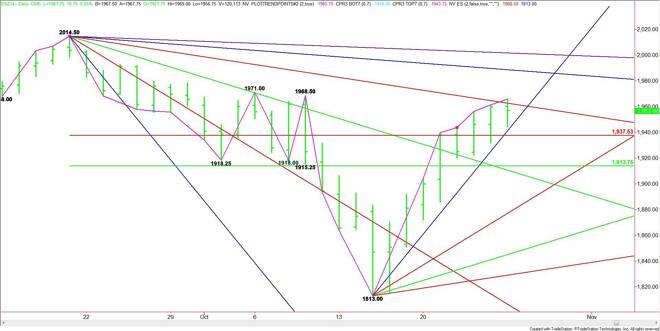

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 28, 2014, Forecast

By:

December E-mini S&P 500 Index futures continued to rally on Monday. The strong close has the index in a position to challenge a pair of main tops at

There may not be an acceleration to the upside however since the index is up nine days from the 1813.00 bottom, putting it in a position to form a potentially bearish closing price reversal top. Traders have to watch the price action on a breakout over 1968.50 and 1971.00 to determine whether real buying or short-covering is driving the market higher.

Key support today comes in at 1957.00. This is a steep uptrending angle from the 1813.00 bottom and also yesterday’s close. Traders will have to hold the market above this angle to maintain the current upside momentum. If it fails to hold then the next support is $1937.75.

On the upside, the first angle to overcome is at 1960.50. As sustained move over this angle will set up a test of the two main tops. The next resistance target is 1987.50, followed by 2001.00. This angle is the last potential resistance before the 2014.50 main top.

The tone of the market today will be determined by trader reaction to 1957.00.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement