Advertisement

Advertisement

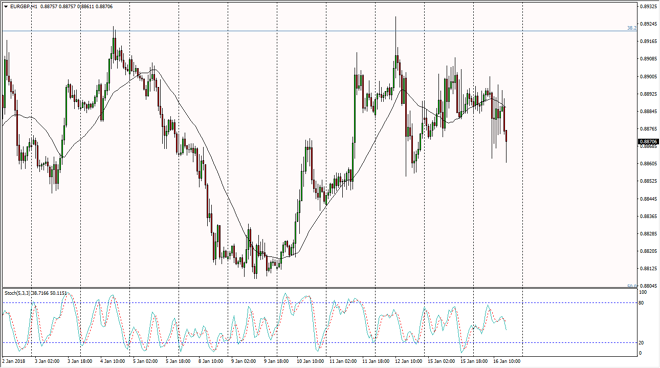

EUR/GBP Price Forecast January 17, 2018, Technical Analysis

Updated: Jan 17, 2018, 08:02 GMT+00:00

The EUR/GBP pair was very noisy, and it now looks as if we are testing a significant support level, at least from short-term perspectives. The market continues to find buyers in the 0.8850 level, just as we continue to see resistance at the 0.89 handle.

The EUR/GBP pair has struggled significantly during the day on Tuesday, as we have bounced around rather radically. The market looks likely to continue to be very choppy and difficult to navigate, which of course makes quite a bit of sense as the European Union and the United Kingdom negotiate the exit of the UK from the EU. Because of this, there are going to be a lot of potential headlines that could cross the wires and make it very difficult. I think that the market is going to continue to be very tight, so look for range bound trading strategies to play this market.

The stochastic oscillator is a perfect indicator for this situation, so if we get some type of oversold condition where the moving averages cross, we could be short-term buyers. Of course, the opposite is true as well, as the 0.920 level above is significant resistance. I believe that the market continues to be very noisy, and I think that given enough time, the markets will offer opportunities in both directions. I think that the larger consolidation area must be paid attention to as well, with the 0.88 level offering a “floor” in the market, and then resistance at the 0.90 level, offering a bit of a “ceiling.”

By being patient, you can take advantage of this type of trading, but expect in a large move is almost impossible, as we have a significant amount of potential inertia build up in this market, but it needs certainty out of the negotiations before can break free.

EUR/GBP Video 17.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement