Advertisement

Advertisement

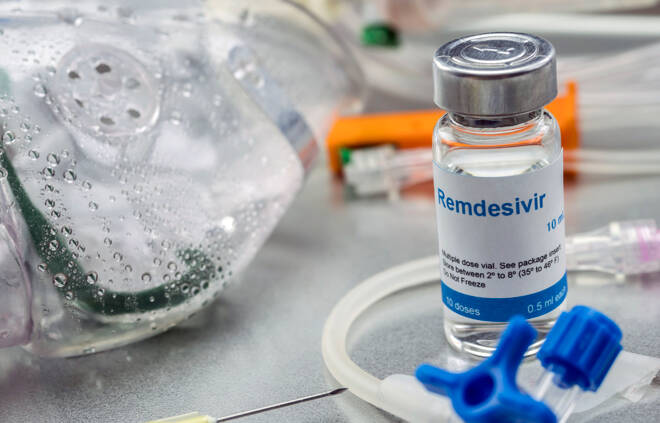

Gilead Sciences Stock Drops With Mixed Results From Remdesivir Trials

Updated: Jun 3, 2020, 07:13 GMT+00:00

Gilead Sciences stock dropped after announcing Phase 3 trial results for remdesivir and this presents a good opportunity for contrarian investors.

Biotech stocks have been on a roll this year as the sector has taken center stage in the fight against Covid-19. Gilead Sciences, Inc. (GILD) is considered to be one of the few companies that could come up with a formidable treatment for the virus, and this expectation has sent shares higher since late-January. Gilead’s drug remdesivir made headlines in March as an experimental treatment for the novel coronavirus and the U.S. Food and Drug Administration issued an emergency use authorization of the drug on May 01.

Last Monday, Gilead announced the results from its Phase 3 trial of remdesivir in patients with moderate pneumonia resulting from Covid-19, and the results were not as promising as many investors thought it would be. Even though the results indicated the drug responds better than most of the standard medicine prescribed to patients, epidemiologists were expecting a significant improvement in patients under the drug, which did not prove to be the case. This led shares lower – from $78 to $73 in the space of two trading sessions.

Analysts Have Cast Doubt Over Gilead’s Success In Fighting The Virus

After the release of trial results, Raymond James analyst Steven Seedhouse wrote in a research note that remdesivir might not become the standard treatment against Covid-19. This comes as a blow to investors who were predicting the drug to bring in more than a billion dollars in revenue by 2021. Elaborating further on his concerns, the analyst wrote, “As soon as a better therapy comes along, which we expect, there would, in fact, be something to lose by choosing remdesivir and forgoing better treatment.”

Jefferies equity analyst Michael J. Yee, the JPMorgan biotechnology research team, and the Barclays health care team have all raised doubts over the ability of remdesivir to become the go-to treatment against the virus.

Gilead’s Promising Outlook

The outlook beyond the pandemic seems to be positive for Gilead as the company has a strong footprint in the fields of oncology and HIV treatment. For instance, BIKTARVY, the HIV treatment launched by Gilead, was the number one prescribed HIV regimen in 2019. This is a billion-dollar market and the company will likely bring in multi-billion dollars in revenue in the coming years. The company is focused on expanding its oncology portfolio as well. Gilead currently has many treatments in early and mid-stage clinical trials that could reach commercialization as early as next year.

The strong pipeline and the success of its existing products will help Gilead deliver good numbers in the coming years, which is a good reason for investors to consider buying Gilead shares on every weakness in the stock price.

About the Author

Dilantha De Silvaauthor

Dilantha specializes in U.S. equities and incorporates a top-down approach to identify developing macro-level trends and the companies that would benefit from such trends.

Advertisement