Advertisement

Advertisement

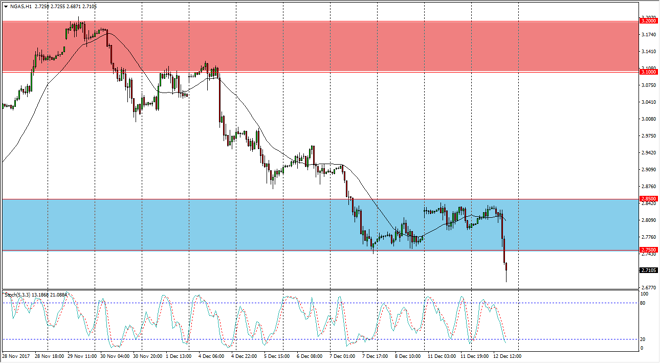

Natural Gas Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:12 GMT+00:00

Natural gas markets were explosive to the downside during the trading session on Tuesday, slicing below the $2.75 level. This is an area that has been massively supportive in the past, so I suspect that we are going to go looking towards the $2.50 level underneath.

The area just above has been massive support, and the fact that we have broken down below there is a very negative sign. I think that the market will go looking towards the $2.50 level underneath, which has been massively supportive. The $2.85 level above is now going to be the top of resistance, and therefore it’s not until we break above there that I would feel comfortable buying this market. Pay attention to the US dollar, because it is offering a significant amount of bearish pressure as well, as a continues to grind higher. This market looks likely to continue to be negative, but if we were to turn around and break above the $2.85 level, the market should then go to the $3.10 level above. This is a market that continues to be very volatile, as the natural gas contracts are sometimes a bit and illiquid.

The fact that the market has broken down is a very negative sign considering that it’s December, and this is seasonably very bullish for natural gas. The market looks absolutely broken at this point, and I think it’s likely that we will continue to see choppiness, and I think that rallies will be sold now. If we broke above the $2.85 level, that would change everything and then would have this market rally again, and a sign of even more volatility than we had previously seen. Expect to see a lot of noise in this market, but quite frankly, I’m a bit surprised.

NATGAS Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement