Advertisement

Advertisement

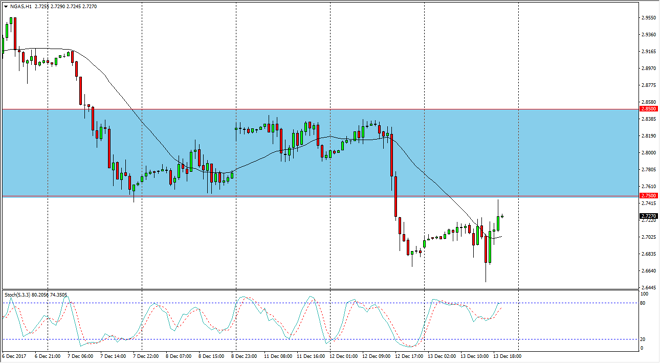

Natural Gas Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 06:00 GMT+00:00

Natural gas markets continue to be very volatile, reaching as high as $2.75 before seeing resistance again. We have broken down through a major support level on the longer-term charts, so I think the next couple of sessions will be very interesting with so much bearish pressure in the market, especially considering that it is December!

Natural gas markets went back and forth during the trading session on Wednesday, reaching towards the $2.75 level. That’s an area that was previous support, so it makes sense that we are starting to see a bit of resistance here. The one-hour chart is showing the stochastic oscillator reaching towards the overbought condition, and looks like it could cross over again. If we were to break above the $2.85 level, that should be a strong move, but I don’t think it’s going to happen in the short term. Now that we have broken down below that area, it’s likely that we should go down to the $2.50 level.

In general, I believe that selling the rallies will be the way going forward, as a breakdown during this time year is unusual indeed. Typically, we get a strong rally in this market as temperatures plunge in the northeastern part of the United States. The fact that we have not says more than I ever could, showing you just how weak the market is. If we did somehow break above the $2.85 level, I think there is a massive ceiling just above the $3.10 level above, and that should continue to be the anchor around the neck of natural gas. The market is decidedly bearish, and it’s difficult to imagine a scenario in which I would want to fight that as the oversupply continues to be a massive problem.

NATGAS Video 14.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement