Advertisement

Advertisement

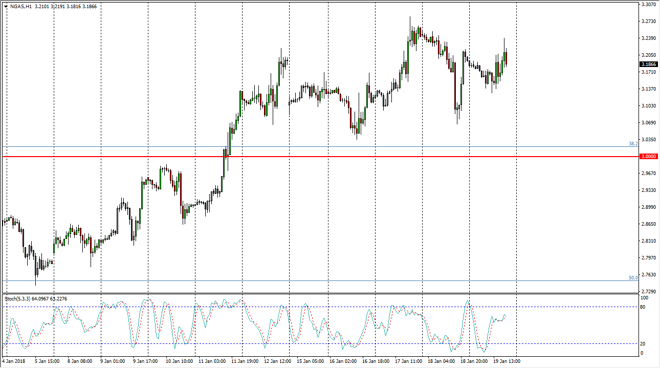

Natural Gas Price Forecast January 22, 2018, Technical Analysis

Updated: Jan 20, 2018, 07:09 GMT+00:00

Natural gas markets went back and forth during the day on Friday, initially dipping, but then rallying. However, as we are getting close to the end of the day as I record this, were starting to roll over again.

Natural gas markets fell during the trading session on Friday, reaching towards the $3.13 level. We found enough support there to bounce and reach towards the $3.23 level, but then turned around to roll over. I think that the market will probably reach down to the $3.10 level, perhaps even down to the $3.00 level. A breakdown below that level would be nasty and massively negative. I think that is what we see given enough time, and therefore I like selling this market on signs of exhaustion, because we are so overextended on the longer-term charts, and of course we are reaching towards the top of the overall consolidation which could extend as high as $3.40. We are much closer to the highs than the lows, so this point it’s easier to sell.

Beyond that, most of the rally has been based upon the recent temperatures in the United States which have been very negative. That drives a demand obviously, but it also makes it difficult to extract natural gas from the ground. Eventually though, both of those issues disappear, and the oversupply returns to the market. Longer-term, I fully anticipate that this market will continue to go back and forth, bouncing around this consolidate a very up but with more of a negative bias than anything else. There are a lot of natural gas suppliers out there that are more than willing to throw supply into the market at these high levels, as it offers profits that they struggle to achieve sometimes.

NATGAS Video 22.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement