Advertisement

Advertisement

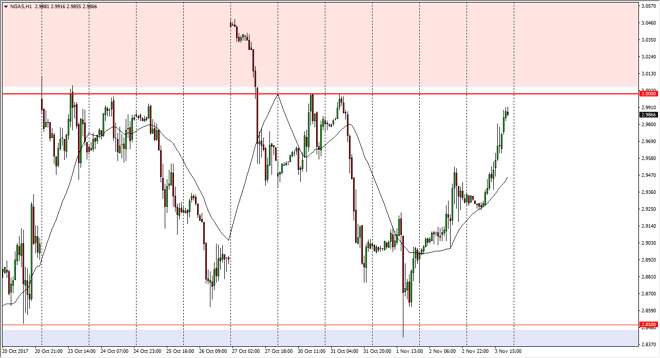

Natural Gas Price Forecast November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:08 GMT+00:00

Natural gas markets initially fell slightly during the day on Friday, reaching towards the 24-hour exponential moving average, as we have dipped down to

Natural gas markets initially fell slightly during the day on Friday, reaching towards the 24-hour exponential moving average, as we have dipped down to find buyers, and then rallied towards the $3.00 level. That’s an area where I expect to see sellers jump back into the market, and that being the case I am more than willing to start shorting this market. Some type of exhaustive candle should be a clue to start shorting again. There is plenty of supply above the $3.00 level, and US fracking companies are more than willing to jump in and flood the market. I think that continues to be an issue, least not until we break above the $3.10 level, something that would be very difficult to do.

Ultimately, the $2.85 level underneath should be massively supportive, and therefore I think that we continue to go back and forth. I will point out that we had formed several hammers over the last several weeks, and that suggests that perhaps we are trying to break out. But it’s not until we get above the $3.10 level that I would be comfortable buying. I don’t think it’s going to happen in the short term, so more than likely it’s going to continue to be “sell the rallies” situation overall. In general, this is a market that I think will continue to be very noisy, but the lack of liquidity should continue to cause violent movements.

If the market continues to this noisy, I think it’s easier to short the market as the longer-term downtrend has been intact. However, I think that the overall positivity could send this market above if we get a sudden cold snap in America. Otherwise, a breakdown below the $2.85 level has this market breaking down rather rapidly.

NATGAS Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement