Advertisement

Advertisement

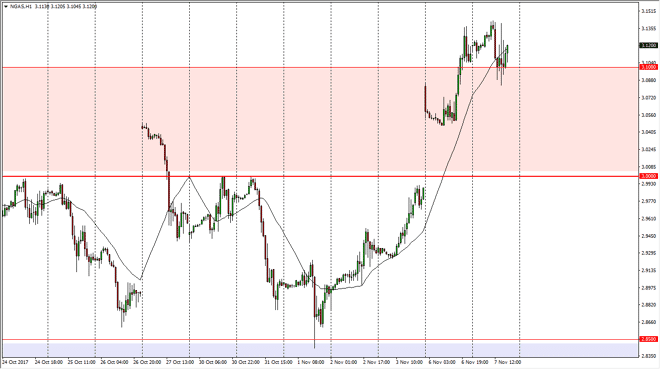

Natural Gas Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 05:27 GMT+00:00

Natural gas markets have rallied significantly during the day on Tuesday, after pulling back to the $3.10 level again. That’s an area that has been

Natural gas markets have rallied significantly during the day on Tuesday, after pulling back to the $3.10 level again. That’s an area that has been massive resistance, and now that we have broken out above that level, it’s likely that we should continue to go towards the $3.20 level, perhaps even the $3.25 level after that. Temperatures in the United States are finally starting to fall, and this could be good for pulling down the inventory of natural gas that we currently have. Longer-term, I still think that natural gas will roll over, but we are heading to that time of year where markets tend to rise due to overall demand. I think the $3.30 level above will be the ceiling in the market, but clearly the buyers have jumped in and gotten aggressive at this point, so more often than not I think the buyers will return, if we can stay above the $3.00 level.

A breakdown below the $3.00 level would be very negative, because it is a gap not only getting filled, but broken down below. I do think that the gap gets filled eventually, but it may not happen until we get closer to spring. If that’s the case, I think that short-term buying on the dips might be an opportunity for traders to get involved. However, I think longer-term traders will be looking for a nice selling opportunity, and then holding onto that position for larger gains. I think the volatility will continue, because quite frankly the lack of liquidity in this market at times will be a major problem. If we were to break above the $3.30 level, that could be a structural change in the overall market. However, with the vast oversupply of natural gas in the continental United States alone, I think that’s very unlikely.

NATGAS Video 08.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement