Advertisement

Advertisement

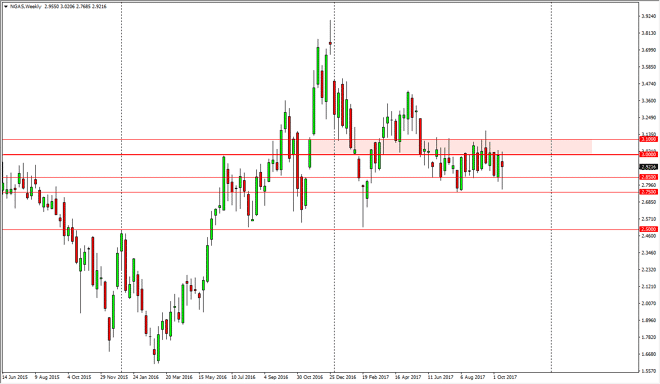

Natural Gas Price forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:22 GMT+00:00

The natural gas markets went back and forth during the course of the week, slicing above the $3.00 level at one point, but then pulling back to break down

The natural gas markets went back and forth during the course of the week, slicing above the $3.00 level at one point, but then pulling back to break down below the $2.85 level. Ultimately, we ended up forming a very noisy looking hammer like candle, and I think that the natural gas markets will continue to be very difficult to trade from a longer-term perspective as we remain range bound overall. That being said, I think that the market will continue to be difficult to trade from a long-term perspective, because quite frankly there isn’t going to be much in the wrist the reward ratio. I think that short-term traders will continue to flock to this market, and therefore longer-term traders at best will probably be looking at trading ETF markets or perhaps even natural gas stocks. I believe it’s not until we break out to a fresh, new high that the natural gas markets can be bought for any real length of time, just as a breakdown below the $2.75 level would be a nice selling opportunity. Until then, short-term traders continue to push this market around, and beyond range bound trading, I don’t see much in the way of an opportunity.

Natural gas has a significant structural problem, because US fracking companies have built up so much in the way of oversupply that every time we get close to the $3 handle, they are willing to flood the market with supply as it’s an opportunity to dump off some of the massive oversupply that they are holding onto, and I think that will continue to be the way going forward, and I don’t foresee a situation where we can break out and above that level for any significant amount of time presently.

NATGAS Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement