Advertisement

Advertisement

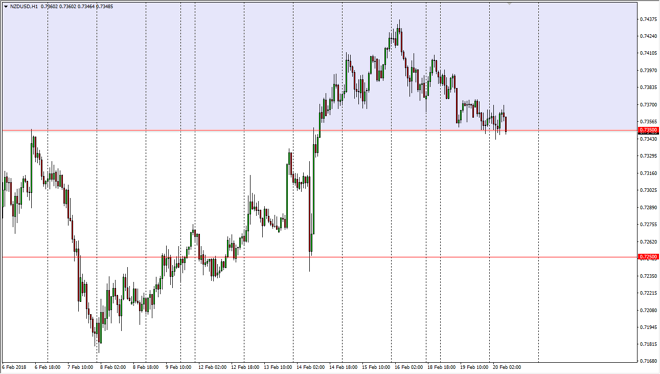

NZD/USD Price Forecast February 21, 2018, Technical Analysis

Updated: Feb 21, 2018, 05:06 GMT+00:00

The New Zealand dollar has gone back and forth during the session on Tuesday, as we bounce around the 0.7350 level. The market looks as if it is trying to stabilize in this area, which makes a lot of sense as it was previous resistance, it should now be support.

The New Zealand dollar has gone back and forth during the trading session on Tuesday, using the 0.7350 level as support. I think that the market is likely to continue to be noisy, because of course the New Zealand dollar pair is the thinnest as far as terms of liquidity is concerned of the major pairs. I believe that the market will bounce around in trying to find support in Sarah, and ultimately, I think that it does rally. However, there is a lot of digestion to get through first, so I think it’s only a matter of time before we get an opportunity to get long, but patience will probably be needed.

If we break down below the 0.73 level, the market probably drops down to the 0.7250 level, which is an area that has proven itself to be supportive for some time. I believe that the market will struggle to break down below that level. In fact, it would take some type of major risk event to break this market down. If we did breakdown, it would probably be accompanied by a general US dollar positive move in the Forex world. Until that happens, I think this is simply a pullback, and that pullback should offer plenty of buying opportunities for those looking for value, which I believe that a lot of people will be. Longer-term, I believe that the US dollar is going to continue to struggle, especially with what’s going on in the bond markets longer term.

NZD/USD Video 21.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement