Advertisement

Advertisement

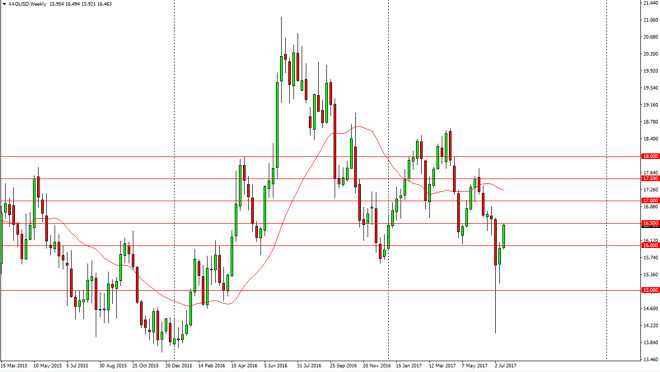

Silver forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:43 GMT+00:00

Silver markets broke higher during the week, slamming into the $16.50 level. That’s an area that should continue to offer resistance, but I think we will

Silver markets broke higher during the week, slamming into the $16.50 level. That’s an area that should continue to offer resistance, but I think we will eventually break above there. Longer-term, looks as if Silver is trying to form some type of floor, and that of course takes several attempts to prove the supportive nature to traders around the world. I think that pullbacks should continue to offer buying opportunities, and eventually will probably go looking towards the $17 level, and then eventually even the $18 level. Silver seems to be technically divided by $0.50 levels, so therefore recognize that there could be buying or selling opportunities in those increments.

US dollar

I believe that the US dollar continues to be sold off, and if that’s the case over should do quite well. I don’t like the idea of selling silver regardless, at least not from a longer-term standpoint. I would not be surprised at all to see this market go looking for the $18 level, perhaps even the $20 level over the longer term. Silver markets seem to see quite a bit of buying pressure in the area just below, so I think that traders will look at pullbacks as value just waiting to happen. If you can deal with very little leverage, the Silver markets might work out quite nicely over the longer term. Be patient though, because it looks as if we are in a consolidation zone. It is not until we break down below the $15 level that I would consider selling from the longer-term perspective, and quite frankly that does not look likely to happen anytime soon. The massive selloff that we had a couple of weeks ago has almost been completely reclaimed as of Friday.

SILVER Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement