Advertisement

Advertisement

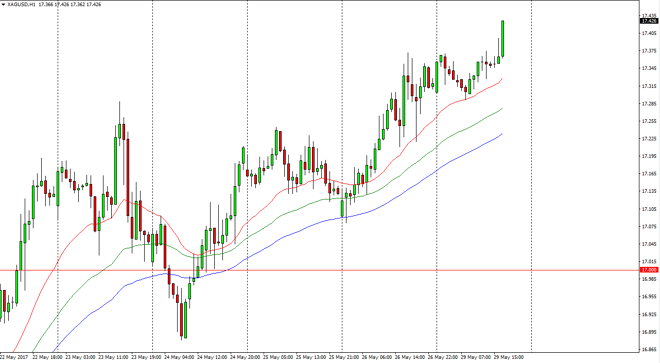

Silver Price Forecast May 30, 2017, Technical Analysis

Updated: May 30, 2017, 05:53 GMT+00:00

Silver markets initially dipped on Monday, but found enough support at the 24 hours moving average to continue the grind higher. Later in the day, the

Silver markets initially dipped on Monday, but found enough support at the 24 hours moving average to continue the grind higher. Later in the day, the Silver markets broke out a bit and it now looks as if we are going to go looking for the $17.50 handle. Ultimately, I believe that the market will probably continue to go even higher than that, and that pullbacks continue to be buying opportunities going forward. I do not have any interest in selling silver, mainly because of the overall bullish attitude of precious metals in general. The $18 level above will continue to be a nice target and of course a large, round, psychologically significant number. I believe that there is a certain amount of resistance there, so I do not expect the silver market to be able to break above it at the first attempt. However, it would not surprise me at all if it did over the longer term. In the meantime, expect quite a bit of volatility.

Buying on the dips

I believe that buying on the dips will probably continue to be the best way to play this market, and off of the short-term charts. Silver markets tend to be very volatile, and that does cause quite a bit of nausea for some traders. However, if you have the ability to focus on short-term charts, you can see that there is a certain amount of stability in the uptrend. I believe that the $17.25 level should be a very supportive level on the short-term charts, and most certainly the $17 level should be supportive on longer-term charts, as it has been more than once. Ultimately, buying is the only thing you can do but you will have to remember how choppy this can be.

SILVER Video 30.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement