Advertisement

Advertisement

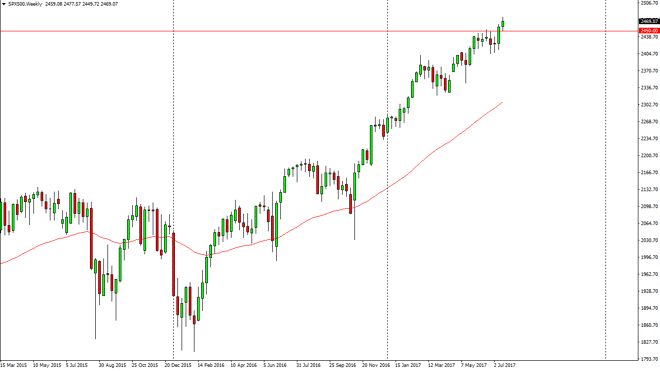

S&P 500 Forecast for the Week of July 24, 2017, Technical Analysis

Updated: Jul 23, 2017, 06:51 GMT+00:00

The S&P 500 initially fell during the week but found enough support of the 2450 level to turn around and bounce higher. The fact that we have done

The S&P 500 initially fell during the week but found enough support of the 2450 level to turn around and bounce higher. The fact that we have done this suggests to me that we are going to continue to go higher, perhaps reaching towards the 2500 level above. I have no interest in shorting this market, because I see a significant amount of support below and extending all the way down to at least the 2400 level. This market has been in an uptrend for some time, and I think will continue to be as people are starting to come to terms with the fact that the Federal Reserve may be a bit more dovish longer-term than originally thought. This of course is good for stocks, and has the market looking for the 2500 level above. The market will be targeting that level, which is a large, round, psychologically significant level.

Buying pullbacks

I continue to buy pullbacks in this market, as it so bullish. I think that the market will eventually break above the 2500 level, and I think that pullbacks are simply opportunities to pick up value in a market that looks very strong. I think that eventually we will break above the leveling start looking for the 2750 level longer term. I have no interest in shorting anytime soon, and even if we break below the 2400 level, I think the buyers would probably come back closer to the 2350 level. The S&P 500 should continue to be supported over the longer term.

S&P 500 Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement