Advertisement

Advertisement

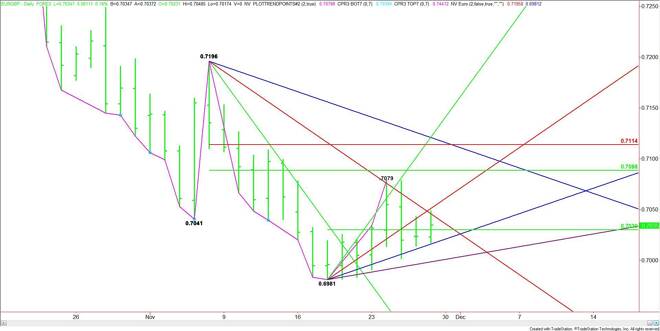

The Best Trading Opportunity Today – EUR/GBP – November 27, 2015

By:

Based on the current price action, the key market to watch today is the EUR/GBP. Currently, the GBP/USD is trading down 0.33%. The EUR/USD is down 0.18%.

Based on the current price action, the key market to watch today is the EUR/GBP. Currently, the GBP/USD is trading down 0.33%. The EUR/USD is down 0.18%.

The GBP/USD reached a low of 1.5030 earlier in the session. If the downside momentum continues then we expect the Forex pair to take out the November 6 bottom at 1.5026. This could lead to an acceleration to the downside if sell stops and fresh shorting pressure hits the market on the move.

The EUR/USD is also trading lower. Its intraday low is 1.0573, just slightly above the November 25 low at 1.0565.

The EUR/GBP is currently trading at .7035. The main trend is down. Its current short-term range is .6981 to .7079. Its 50% level or pivot is .7030. This price is currently controlling the short-term direction of the market. Holding above this pivot price could create enough upside momentum to challenge a long-term downtrending angle at .7046.

Taking out .7046 should fuel a fast rally into an uptrending angle at .7051. Overtaking this angle will put the EUR/GBP in a strong position. This could fuel an acceleration to the upside with the first target a minor top at .7079. This is followed closely by a major 50% level at .7088.

With the EUR/GBP building a support base since the November 18 bottom at .6981 we’re looking for an acceleration to the upside today.

The catalyst behind the rally could be a strong recovery by the Euro or a steep break by the British Pound. If there is a steep sell-off in the U.S. equity markets because of the weakness in the Chinese markets, we could see the Euro rally because of the carry trade. We saw a move like this in late August when a market crash in China led to a steep break in U.S. equities.

This is one reason why we believe that a breakout to the upside by the EUR/GBP is the trade of the day. It’s a counter-trend move and a momentum play, but the risk/reward of the trade is good especially if buyers can overcome .7051 with conviction.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement