Advertisement

Advertisement

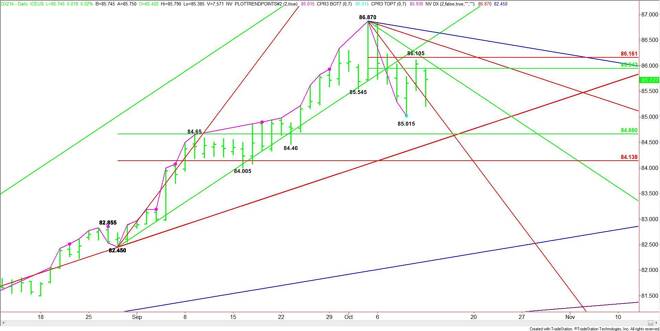

US Dollar Index (DX) Futures Technical Analysis – October 14, 2014 Forecast

By:

The December U.S. Dollar Index futures contract finished lower on Monday, helping to form a new minor top at 86.105. The short-term range is 86.87 to

The December U.S. Dollar Index futures contract finished lower on Monday, helping to form a new minor top at 86.105.

The short-term range is 86.87 to 85.015. The retracement zone of this range at 85.94 to 86.16 stopped the rally on Friday at 86.105 and remains resistance today. A downtrending angle from the 86.87 top passes through this zone today at 86.00, making it a valid target also.

A breakout over 86.16 could trigger a rally into downtrending angles at 86.43 and 86.65. These are the last two angles before the 86.87 main top.

Bearish traders are trying to form a potentially bearish secondary lower top inside the 85.94 to 86.16 retracement zone. If they succeed then additional downside pressure should emerge.

The main range is 82.45 to 86.87. Its retracement zone at 84.66 to 84.14 is the next major downside target. A long-term angle from 82.45 passes through this zone at 84.51, making it a valid downside target.

The tone of the session today is likely to be determined by trader reaction to the retracement zone at 85.94 to 86.16. A failure at 85.94 will indicate selling pressure while a breakout over 86.16 will be bullish.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement