Advertisement

Advertisement

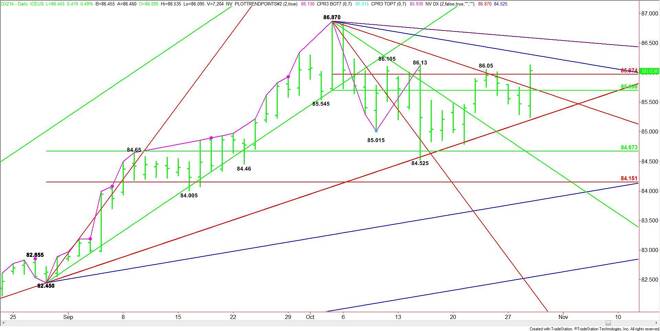

US Dollar Index (DX) Futures Technical Analysis – October 30, 2014 Forecast

By:

December U.S. Dollar Index futures had a volatile day on Wednesday, posting an outside move and a higher close. This gives the market an early upside bias

December U.S. Dollar Index futures had a volatile day on Wednesday, posting an outside move and a higher close. This gives the market an early upside bias today. The catalyst behind the volatility and the higher close was the Fed announcement at 2:00 pm EDT.

In its statement, Fed policymakers implied the central bank was moving toward a tighter monetary policy more quickly than its peers at the Bank of England and the European Central Bank.

The Fed also announced the end to its monthly bond-buying at the end of this month. In addition, it said in its statement that interest rates could rise sooner or later, depending on how the economy performs. The central bank also dropped the word “significant” in describing underutilization of the labor market. This serves as a sign that it has turned more upbeat on the jobs market.

Technically, the index is still trading inside its main range defined as 86.87 to 84.525. On Wednesday, the market closed on the bullish side of its retracement zone at 85.70 to 85.97. This move could create enough upside momentum to drive the market into the next two downtrending angles at 86.28 and 86.57. These are the last two angles before the 86.87 main top.

On the downside, the first support is 86.57, followed by 86.28. Taking out the latter could put enough selling pressure on the market to drive it back to 85.26. This price is on an angle that is holding the structure of the market intact. Sentiment will change to down if this price is taken out with conviction.

Look for a strong tone as long as 85.97 holds as early support. Holding it will mean follow-through buyers are coming in. This should be accompanied by rising volume. The 50% level at 85.70 is the most important support, however.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement