Advertisement

Advertisement

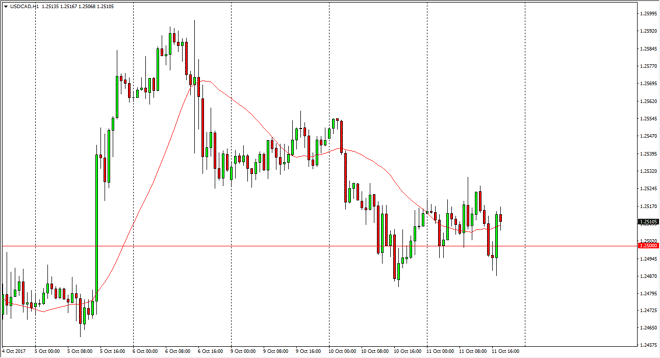

USD/CAD Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:54 GMT+00:00

The US dollar continues to chop around the 1.25 level against the Canadian dollar, as this is a very important level. It obviously attracts a lot of

The US dollar continues to chop around the 1.25 level against the Canadian dollar, as this is a very important level. It obviously attracts a lot of attention in both directions, and with oil markets being so jumpy, it makes sense that the Canadian dollar will continue to bounce around. We are recently looking at the Canadian central bank with suspicion, because after a surprise rate increase, the next thing that was stated as any type of strategy was that you should not assume that interest rate hikes are going to be “automatic and mechanical” coming out of Ottawa. Because of this, the Canadian dollar has cooled off, but we also have to worry about the Federal Reserve, and what they may be hitting ready to do, or maybe not do.

If we break down below the 1.2450 level, I think the market will probably go looking towards the 1.20 level over the longer term. This coincided with a stronger oil market, that would make even more sense. Alternately, if we break above the 1.26 level, that’s a longer-term “buy-and-hold” signal in this pair as we should continue to reach towards the 1.30 level after that. In the meantime, I expect a lot of choppiness, and of course the jobs number last week only muddied the water even more, so I think this pair will continue to be difficult to deal with. However, if history is any type of indication, once we get some type of momentum in either direction, the market will take off. This market consolidates a lot, followed by very intense bursts of momentum. I don’t think this is can be any different, and therefore I think that waiting for a breakout of this general range is probably the best way to play this market.

USD/CAD Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement