Advertisement

Advertisement

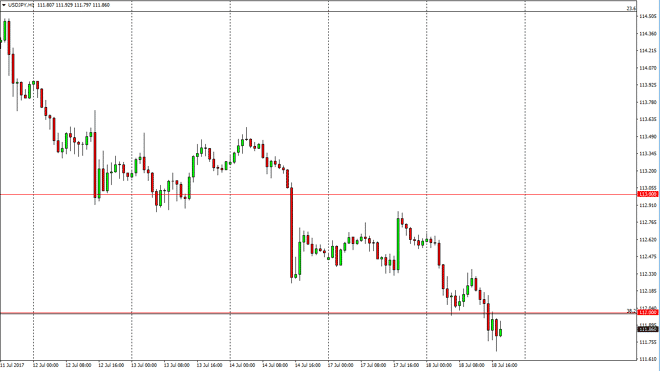

USD/JPY Forecast July 19, 2017, Technical Analysis

Updated: Jul 19, 2017, 05:57 GMT+00:00

The USD/JPY pair fell during the day on Tuesday, slamming into the 112 level, and then eventually falling through it. However, later in the day it looks

The USD/JPY pair fell during the day on Tuesday, slamming into the 112 level, and then eventually falling through it. However, later in the day it looks as if we are trying to break back above the level and if we do, I believe that a move above the 112.30 level could send this market back towards the 113 handle. A break above there census market to the 114.50 level after that. I believe that the market continues to see plenty of volatility, as this pair is highly influenced by the risk appetite around the world. The interest rate differential still favors the US dollar, but given enough time I think the market is going to start focusing on the Federal Reserve and its interest rate hike expectations. Some of those expectations have cooled off a bit, and that has correlated precisely with the decline in this currency pair.

Japanese yen

The Japanese yen continues to be what I am paying the most attention to, because quite frankly the Japanese yen is very soft, and is being sold off against several currencies around the world. However, a breakdown below the low from the session could send this pair looking towards the 110 level which is the next major support level. In fact, I believe that the 110 level is even more supportive, and I would become bullish in that area if we broke down. Longer-term, I still believe that the uptrend is going to be what we continue to find, and the given enough time we will go higher. However, and the short-term is very likely that we will continue to see short-term bearish pressure. However, as soon as we get inflationary numbers coming out of the United States, this will turn this market around.

USD/JPY Video 19.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement