Advertisement

Advertisement

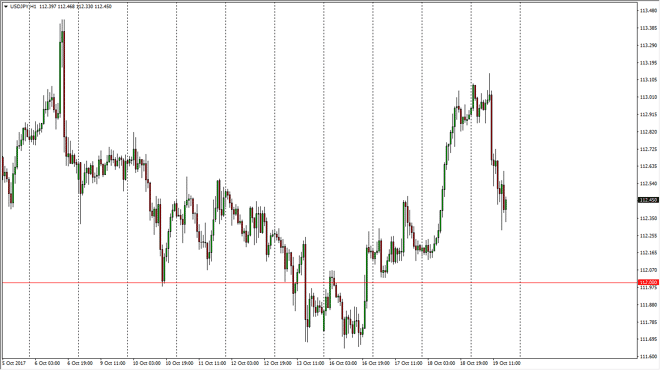

USD/JPY Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 05:55 GMT+00:00

The US dollar initially was sideways against the Japanese yen on Thursday, but then fell rather significantly, slicing through the 113 handle. We started

The US dollar initially was sideways against the Japanese yen on Thursday, but then fell rather significantly, slicing through the 113 handle. We started to find buyers near the 112.50 level, and it now looks as if we are trying to stabilize and perhaps rally from there. Because of this, the market looks very healthy, considering that this pullback was so brutal yet we are finding ourselves sitting sideways. Given enough time, I still think that we go towards the top of the overall consolidation area which is closer to the 114.50 level, and I also think that the pullback will be looked at as value. In fact, we are at roughly the 50% Fibonacci retracement level from the bottom, and I think that of course will attract a lot of algorithmic traders and of course longer-term players.

112 should continue to be supportive, and if we can stay above there I don’t see any reason to short this market. Even if we do break down below there, I think that the 111 level is supportive as well, if not more so. Longer-term, I believe that we will break above the consolidated resistance, and become more of a buy-and-hold market, but right now we obviously have extreme amounts of volatility to deal with. The marketplace continues to be very sensitive to risk appetite, but if it starts to turn upward again, that should be the catalyst to get traders back into this market and aiming for the 113 level, and that of course the 114.50 level. Once we get above 115, then I become a buy-and-hold trader as I think we will probably go looking towards the 120 handle after that. In the meantime, is can be volatile but I remain bullish.

USD/JPY Video 20.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement