Advertisement

Advertisement

The RBA, Stats, and Powell Put the Aussie Dollar, the EUR, and the U.S Dollar in Focus

By:

It's a relatively busy day ahead. The RBA policy decision and economic data are in focus. There is also Trump's health and Brexit to monitor...

Earlier in the Day:

It’s was a relatively quiet start to the day on the economic calendar this morning. The Aussie Dollar was in action this morning.

For the Aussie Dollar

It is a busy morning, with August trade figures in focus ahead of the RBA monetary policy decision later this morning.

In August, the trade surplus narrowed from A$4.607bn to A$2.643. Economists had forecast a widening to A$5.154bn.

According to the ABS,

- Exports of goods and services fell A$1,431m (4%) to A$32,638m.

- Non-monetary gold exports fell A$2,234m (62%), with the export of services falling A$140m (3%).

- Exports of non-rural goods rose A$577m (3%), with exports of rural goods rising A$366m (12%).

- The net exports of goods under merchanting remained steady at A$16m.

- Imports of goods and services rose A$579m (2%) to A$29,996m.

- Consumption goods imports rose A$553m (6%).

- Imports of intermediate and other merchandising goods rose A$323m (3%).

- There were also increases in the imports of non-monetary gold (10%) and services (1%).

- Imports of capital goods fell A$488m (7%), however.

The Aussie Dollar moved from $0.71907 to $0.71877 upon release of the data that preceded the RBA policy decision and rate statement. At the time of writing, the Aussie Dollar was up by 0.11% to $0.7189.

Elsewhere

At the time of writing, the Japanese Yen was up by 0.04% ¥105.71 against the U.S Dollar, with the Kiwi Dollar up by 0.08% to $0.6651.

The Day Ahead:

For the EUR

It’s a relatively busy day ahead on the economic calendar. Key stats included August factory orders and September construction PMI figures from Germany.

Expect Germany’s factory orders to be the key driver.

On the monetary policy front, ECB President Lagarde is due to speak later in the day. Expect any chatter on the economy and COVID-19 or monetary policy to influence.

Away from the economic calendar, any updates on Brexit will also need monitoring. There’s also COVID-19 to consider as Europe continues to grapple with the pandemic.

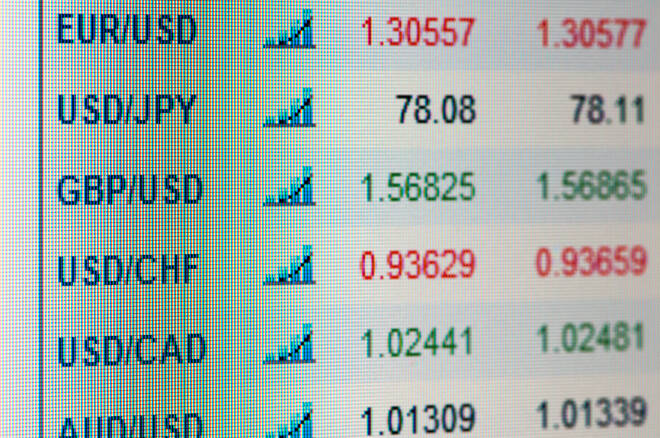

At the time of writing, the EUR was up by 0.03% to $1.1787.

For the Pound

It’s a relatively quiet day ahead on the economic calendar. Key stats include September’s construction PMI.

Barring particularly dire numbers, however, the PMI should have a limited impact on the Pound.

With Brexit talks resuming in London this week, updates on Brexit will be the key driver. COVID-19 news updates will also need to be monitored, however.

Any talk of needing to add further containment measures would be Pound negative.

At the time of writing, the Pound was up by 0.05% to $1.2986.

Across the Pond

It’s also a relatively busy day ahead for the U.S Dollar. Key stats include August trade data and JOLTs job openings.

With sensitivity towards labor market numbers on the rise once more, expect the JOLTs numbers to be the key driver.

On the monetary policy front, FED Chair Powell could provide direction later in the day, though we aren’t expecting any surprises.

Away from the economic calendar, updates on Trump’s health, the relief Bill, and election chatter will also be in focus.

The Dollar Spot Index was down by 0.09% to 93.426 at the time of writing.

For the Loonie

It’s a relatively quiet day ahead. August trade figures are due out later today.

We can expect the numbers to influence, though any major move would be dependent upon market risk sentiment.

At the time of writing, the Loonie was up by 0.07% to C$1.3254 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement