Advertisement

Advertisement

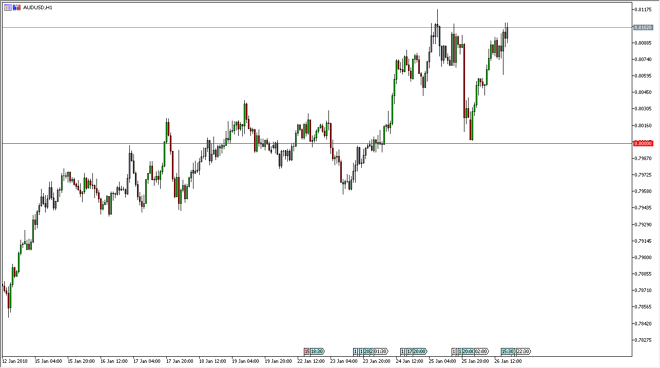

AUD/USD Price Forecast January 29, 2018, Technical Analysis

Updated: Jan 27, 2018, 05:36 GMT+00:00

The Australian dollar has bounced radically during the trading session on Friday, as we continue to see an upward pressure in this market. The 0.81 level is the top of a major fulcrum for price, and that should continue to be an area of significant interest.

Out of all the currency pairs that I follow here at FX Empire, the AUD/USD pair is garnering the most attention. If we can break above current areas, I think that the market will extend much higher levels, as the 0.80 level is important in this pair, going back to the 1980s. A break above this general vicinity should send this market looking towards the 0.85 level. That level should be the first target, and then possibly the 0.90 level after that. The market continues to sell off the US dollar, and I believe that the market should continue to be leaning that direction overall. The Australian dollar of course is highly leveraged to gold, which is starting to see a lot of interest as well. Overall, I think that this market is in a bit of a “perfect storm”, as the greenback suffers.

Pullbacks should offer value, with the 0.80 level underneath offering massive support. That level will be a bit of a “floor” for short-term traders, and I think that now that we have seen such a violent snap back in this market, it’s only a matter of time before we see massive amounts of money flowing into this pair. The marketplace will more than likely continue to be choppy, but certainly we have seen the market show its hand, and its overall preference. If we were to break down below the 0.80 level, I think there is plenty of support below and I would wait for a bounce to take advantage of, not sell.

AUD/USD Video 29.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement