Advertisement

Advertisement

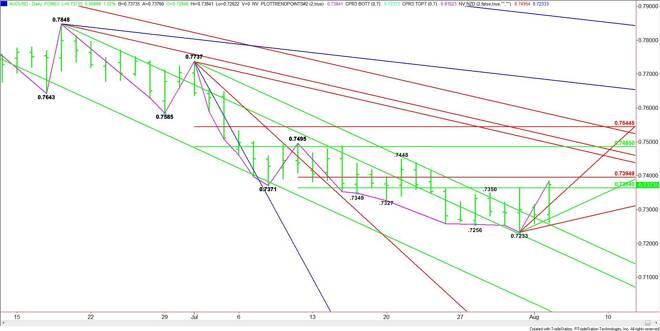

AUD/USD Forex Technical Analysis – August 4, 2015 Forecast

By:

The AUD/USD rallied sharply higher after the Reserve Bank of Australia kept its benchmark cash interest rate unchanged at 2%. The market firmed after RBA

The AUD/USD rallied sharply higher after the Reserve Bank of Australia kept its benchmark cash interest rate unchanged at 2%. The market firmed after RBA Governor Glenn Stevens suggested the Australian economy is on track. Traders reacted as if this meant we’ve seen the end of the interest rate cycle.

In a written statement, Governor Glenn Stevens sounded optimistic which may have been the catalyst behind the strong rally. He said, “In Australia, the available information suggests that the economy has continued to grow. While the rate of growth has been somewhat below longer-term averages, it has been associated with somewhat stronger growth of employment and a steady rate of unemployment over the past year.”

Although the news today triggered a strong short-covering rally, gains could be limited because of the threat of an interest rate hike by the Fed in September. This Friday’s U.S. Non-Farm Payrolls report should let us know if the labor market is strong enough to warrant an early rate hike.

Technically, the main trend is down according to the daily swing chart, however, today’s rally and confirmation of the closing price reversal bottom from July 31 indicate that momentum has shifted to the upside.

The short-term range is .7495 to .7233. Its retracement zone at .7364 to .7395 is currently being tested. Trader reaction to this zone should set the tone for the rest of the session.

Currently, the market is at .7369, giving the market an upside bias. A break below this level could test support at .7313 and .7273.

A sustained move over .7364 set up the market for a rally into the Fibonacci level at .7395. The daily chart opens up to the upside over this level with potential targets at .7485, .7495 and .7497.

Based on the current price at .7369, the direction of the market the rest of the session will be determined by trader reaction to .7364.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement