Advertisement

Advertisement

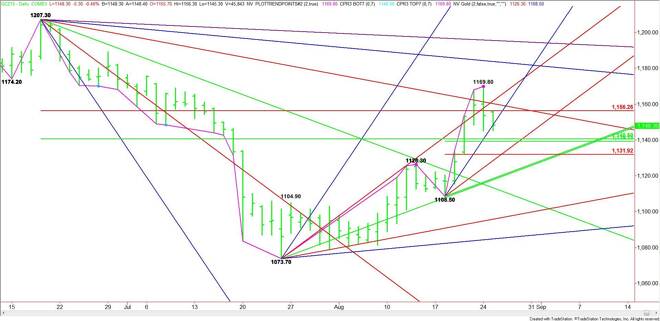

Comex Gold Futures (GC) Technical Analysis – August 25, 2015 Forecast

By:

December Comex Gold futures posted a potentially bearish closing price reversal top on Monday. The chart pattern will be confirmed on a break through

December Comex Gold futures posted a potentially bearish closing price reversal top on Monday. The chart pattern will be confirmed on a break through $1145.10. Based on the short-term range of $1108.50 to $1169.80, the primary downside objective today is its retracement zone at $1139.10 to $1131.90.

Currently, the market is straddling an uptrending angle at $1148.50. Trader reaction to this angle will likely determine the direction of the market today.

Holding above $1148.50 will signal the presence of buyers. Look for a labored rally, however, because of the tight resistance at $1156.30, $1160.30 and $1161.70. Overcoming and sustaining a rally over $1161.70 will indicate that the buying is getting stronger. This could trigger a rally into yesterday’s high at $1169.80.

Taking out $1169.80 will negate the closing price reversal top. This could trigger a surge to the upside with the next target coming in at $1183.80. This is also a trigger point for an acceleration to the upside with $1195.60 the next target. This is the last potential resistance before the $1207.30 main top.

A sustained move under $1148.50 will signal the presence of buyers. Taking out $1145.10 will confirm the closing price reversal top.

The first downside target is a major 50% level at $1140.50. This is followed closely by another 50% level at $1139.10 and the 61.8% level at $1131.90. Additional targets are an uptrending angle at $1128.50 and a pair of angles at $1118.50 and $1117.70.

Watch the price action and order flow at $1148.50. This will tell us whether the bulls or the bears are in control. The same goes for yesterday’s low at $1145.10. A trade through this price will confirm the potentially bearish closing price reversal top.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement