Advertisement

Advertisement

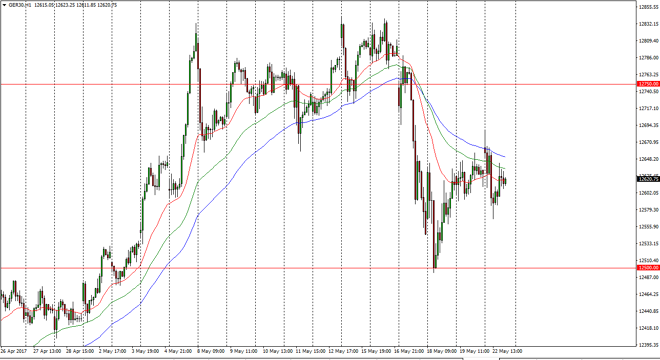

DAX Index Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:07 GMT+00:00

The DAX gapped higher at the open on Monday, reaching towards the €12,700 level. However, we turned around and fell significantly, reaching towards the

The DAX gapped higher at the open on Monday, reaching towards the €12,700 level. However, we turned around and fell significantly, reaching towards the €12,550 level underneath. By the time, we got into the US trading session, the market essentially formed a neutral candle for the day. The hourly chart still looks a little bit confused, as we have broken out on that gap above a bit of resistance, but then broke down below it again. Now it looks as if the market is probably going to stay in some type of tight range, and that makes sense considering how confuse the market seems to be in general right now. The market looks likely to see a bit of choppiness, and I believe that the €12,500 level underneath will be the “floor” in the market. Because of this, as long as we can stay above there I prefer to buy dips, but I also recognize that it could be very difficult to hang on through all of the volatility.

Longer-term uptrend

The longer-term uptrend is still very much in effect, although the recent fall has been significant. It’ll be interesting to see what happens next, because Angela Merkel has just suggested that the value of the euro currency is too strong. That can have an effect on German exports if the value rises, so it could be a bit of a drag on this index, but ultimately the trend has not changed. If we can break down below the €12,500 level, then the market will probably go much lower. Until then, I believe that the buyers will have the upper hand, but it isn’t going to be easy. You will have to be very patient with the continuing uptrend, and give your trade some room to breathe.

DAX Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement