Advertisement

Advertisement

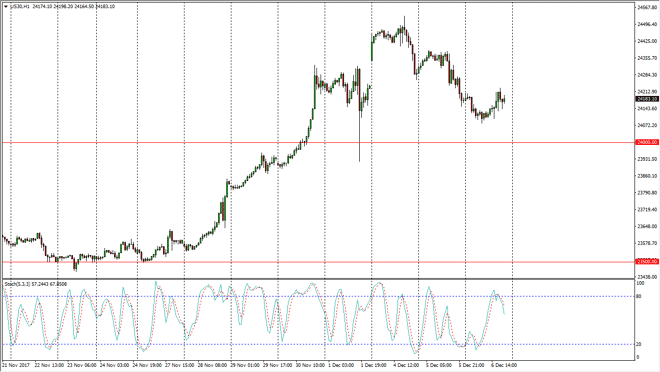

Dow Jones 30 and NASDAQ 100 Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:03 GMT+00:00

The Dow Jones initially dipped during the day, but found enough bullish pressure to turn around again. I think there is plenty of support underneath both markets to continue to attract algorithmic trading.

Dow Jones 30

The Dow Jones 30 pulled back slightly during the trading session on Wednesday, but continues to have a massive amount of support near the 24,000 level. With algorithmic traders coming in and picking up these dips every time they happen for any length of time, I believe it’s only a matter of time before the Dow Jones 30 rallies again. The 24,500 level above would be the target again, as that is where we formed the recent highs. If we were to break down below the 24,000 level, then I think we probably drop about another 250 points, where I would expect to see support.

Dow Jones 30 and NASDAQ Index Video 07.12.17

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Wednesday to test the 6225 level. We bounce from there to break towards the 6300 level, and although we are a bit overbought, I believe that eventually the buyers will come in and push the NASDAQ 100 higher. That being said, I am much more comfortable buying the Dow Jones 30 or even the S&P 500 and the NASDAQ 100, as tech stocks around the world have been absolutely pummeled over the last several sessions. This being the case, although I am bullish I will probably focus most of my attention on the other markets. If we were to break down below the 6225 handle, I think the NASDAQ 100 could find itself in a lot of trouble. All things being equal, I believe that all of the US indices will rise over the next several sessions.

3

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement