Advertisement

Advertisement

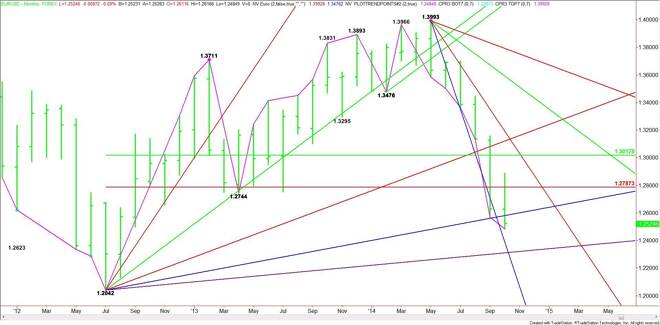

EUR/USD Monthly Technical Analysis for November 2014

By:

The EUR/USD continued its downtrend in October although the selling pressure subsided a little during the second half of the month. The fundamentals

The EUR/USD continued its downtrend in October although the selling pressure subsided a little during the second half of the month. The fundamentals remain bearish although the better-than-expected inflation data released late in the month helped take some of the wind out of the sails of the bears.

The overall tone, however, is still bearish amid speculation the European Central Bank is getting ready to implement additional stimulus. The action by the Bank of Japan to increase its stimulus may have created a “stimulus war” which could encourage the ECB is follow suit soon.

Technically, the main trend is down on the monthly chart. The main range is 1.2042 to 1.3993. The retracement zone created by the range at 1.2787 to 1.30175 is new resistance. The first resistance, however, is an uptrending angle at 1.2602.

On the downside, the best target is a slow-moving uptrending angle from the 1.2042 bottom at 1.2322. This is followed by the July 2012 bottom at 1.2042.

With the Fed leaning toward raising rates because of the improving U.S. economy and the Euro Zone economy hovering above a deflationary state, the bias is still to the U.S. Dollar. Oversold conditions may produce a few short-covering rallies this month, but this will be position-squaring by the major players. Because of the overwhelmingly bearish fundamentals, all short-covering rallies are likely to be great selling opportunities.

Last month’s decision by the BoJ to increase stimulus may force the ECB to get more aggressive. This could mean the announcement of fresh stimulus measures. This would put the Euro under great pressure. Continue to press the EUR/USD especially after short-covering rallies.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement