Advertisement

Advertisement

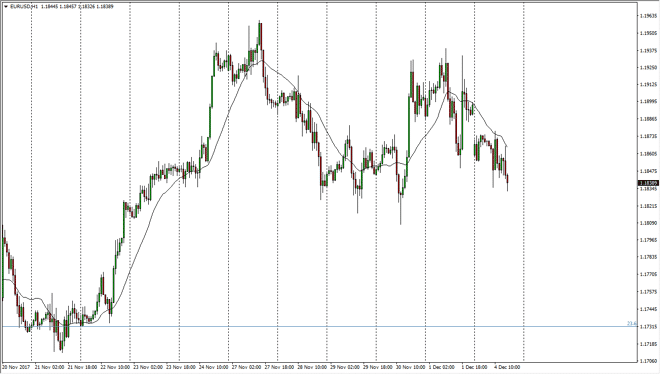

EUR/USD Price Forecast December 5, 2017, Technical Analysis

Updated: Dec 5, 2017, 05:55 GMT+00:00

The EUR/USD pair gapped lower at the open on Monday, as traders got excited about a potential tax bill being signed in the United States. However, there are is the larger picture to pay attention to.

As we opened the trading session on Monday, we obviously gapped lower in favor the US dollar during Asian trading, perhaps in reaction to the tax bill making significant gains through the US Senate. Ultimately, the question then becomes where do we go from here? I think that the move to the upside it’s very likely that we will continue to see the pair rise. In fact, I believe that the 1.17 level underneath is massively supportive, and it’s not until we break down below there that I would be thinking about selling. That being said, I do recognize that there is a lot of noise above, and the 1.21 level is a massively resistant level, and that being broke and could lead us into more of an investment, and less of a trade. I think eventually that’s what happens, especially if inflationary pressures can pick up in the European Union.

If we were to break down below the 1.17 level underneath, I think the market probably goes looking towards the 1.15 handle underneath. That would throw the market into a bit of disarray, and I think that the overall momentum will continue though, so it’s difficult to imagine selling this market for any length of time. Also, when I look at the hourly chart I see that we are starting to see support again at the 1.18 level underneath, and therefore if we can bounce, I think we will fill the gap from the open, and then eventually go towards the 1.1950 level next. In general, I’m a buyer but I recognize volatility is ahead of us.

EUR USD Forecast Video 05.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement