Advertisement

Advertisement

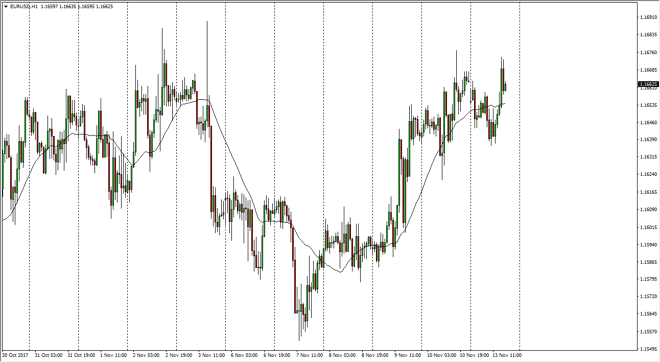

EUR/USD Price Forecast November 14, 2017, Technical Analysis

Updated: Nov 14, 2017, 04:45 GMT+00:00

The Euro gapped lower at the open on Monday, but then found support as we drove down to the 1.165 handle. That is an area that has been important a couple

The Euro gapped lower at the open on Monday, but then found support as we drove down to the 1.165 handle. That is an area that has been important a couple of times in the recent past, and we have bounced significantly from there. The 1.1675 level has offered resistance, but there’s even more importance attached to the 1.17 handle above. That was the neckline from the head and shoulders on the daily chart, so I think it’ll be interesting to see how the 1.17 level plays out. If it continues to offer resistance, then it could be a nice selling opportunity as we get near there. Any type of exhaustion could be a nice opportunity to pick up value in the US dollar. Remember, Mario Draghi has suggested that the ECB would extend quantitative easing, although at lower levels. That really put a beating on the Euro, and this of course favors the US dollar. However, recently we have seen a lot of problems passing tax bills in the U.S. Congress, and that is essentially what is going on right now, the dollar is being punished for that.

The catalyst for the market rolling over could come out of Washington DC, and cross the wires at any time. That’s essentially what I think needs to happen to continue the overall move lower after the head and shoulders it should translate to a reading of 1.13 in the pair. However, if we close above the 1.1725 level on the daily chart, I believe that the head and shoulders has been completely wiped out, and that we should then go to the 1.20 level above, which extends to the 1.21 level based upon the resistance. A break above there is indeed a very strong sign.

EUR USD Forecast Video 14.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement