Advertisement

Advertisement

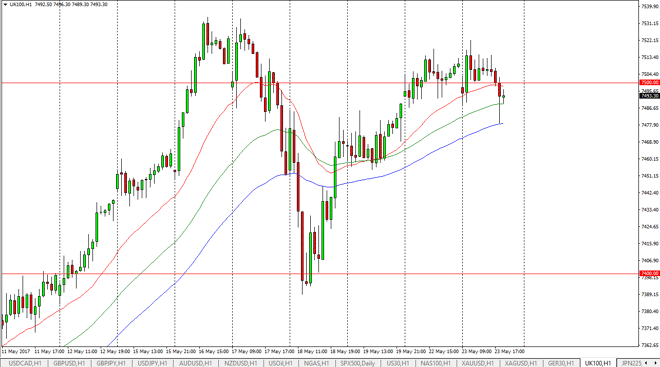

FTSE 100 Index Price Forecast May 24, 2017, Technical Analysis

Updated: May 24, 2017, 03:44 GMT+00:00

The FTSE 100 had a relatively choppy session on Tuesday, as we initially rallied to the 7520 handle, and then fell all the way down to the 7475 level. We

The FTSE 100 had a relatively choppy session on Tuesday, as we initially rallied to the 7520 handle, and then fell all the way down to the 7475 level. We bounce from there, and it looks as if we are going to continue to hover around the 7500 level. This shows a bit of indecision, but after the recent rally it’s not a huge surprise to see the market churning a bit at the highs. I believe that the market should continue to go higher, but we may have to build up a bit of a position in this area and of course volume in order to have the momentum necessary to go higher. Ultimately, I do think that we break out to a fresh, new high, and that the market will continue the longer-term uptrend that we have seen.

Value play

I believe that the FTSE 100 will continue to benefit from a historically cheap British pound, and I think the market should continue to see quite a bit of bullish pressure due to that, and the British economy doing better than ones anticipated. I believe that the global stock indices in general are going to continue higher, so that by default will help the FTSE overall. The FTSE 100 is heavily export laden, and with that as long as the rest the world is doing reasonably well, one would have to assume that the FTSE 100 will follow suit. I believe in buying dips, just as we have seen during the session on Tuesday, and I also believe that the 7400 level should now offer a bit of a floor in a market that looks very healthy going forward. Longer-term, I believe the market goes to the 7600 level over the next several weeks.

FTSE 100 Video 24.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement