Advertisement

Advertisement

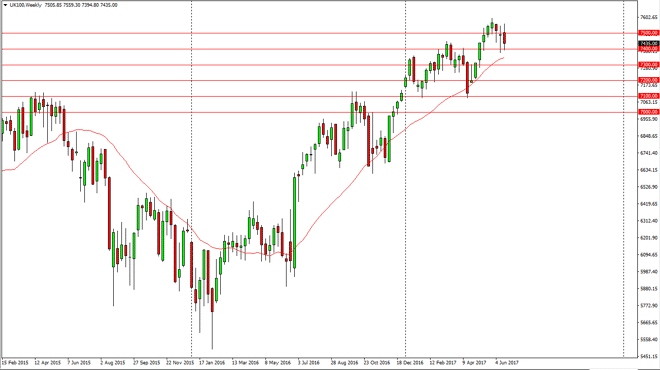

FTSE 100 Price forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:16 GMT+00:00

The FTSE 100 initially tried to rally during the week, but found it a bit difficult above the 7500 level. We turned around to fall significantly and reach

The FTSE 100 initially tried to rally during the week, but found it a bit difficult above the 7500 level. We turned around to fall significantly and reach towards the 7400 level under that, which of course was supportive. With this being the case, it’s likely the buyers will return, as 7400 has been so important in the past. I believe that the 7400 level previously was rather resistive, and that should now be supportive. A break above the 7600 level could happen relatively soon, and I believe that buying is the only thing you can do. As you can see on the chart, I have the 20 week exponential moving average in front of you, and of course the chart is sliced into 100 point increments. It appears that the markets are paying attention to these levels, and I think that the 100 level should continue to offer support and resistance.

Buying dips

I believe in buying dips, as the market has shown such a proclivity to go higher and of course we have the British pound falling longer term. The market looks likely to be volatile, but export should continue to pick up, and that of course should continue to send the FTSE 100 to higher levels. I currently believe that we will eventually reach the 8000 handle, but it is going to take a significant amount of time to get to that level.

As long as we can stay above the 7000 handle, I believe that the longer-term trend is to the upside, and therefore it’s not until we break down below there that I would consider selling, although I recognize there will be a lot of noise coming out of the negotiations between the United Kingdom and the European Union.

FTSE 100 Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement