Advertisement

Advertisement

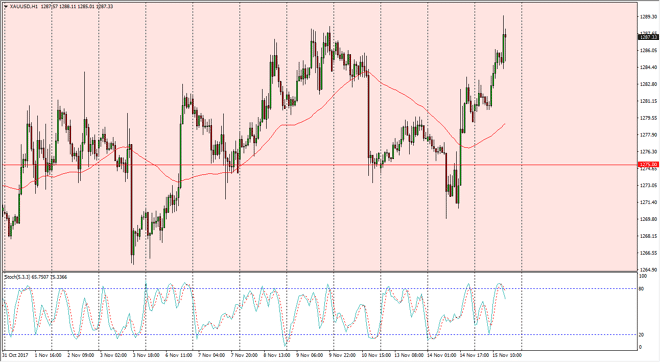

Gold Price Forecast November 16, 2017, Technical Analysis

Updated: Nov 16, 2017, 05:15 GMT+00:00

Gold markets have had a very bullish Wednesday, breaking towards the $1290 level. That’s an area that has caused a bit of resistance in the recent trading

Gold markets have had a very bullish Wednesday, breaking towards the $1290 level. That’s an area that has caused a bit of resistance in the recent trading action, and I think we will continue to see a bit of bearish pressure there. However, if we are to clear the $1290 level, the $1300 level would be all but assured as it would make too much sense from a technical standpoint. However, we are truly broken out until we can clear well above $1300, and that’s not something that I see happening. In fact, we are starting to look a little overbought on the one-hour chart, as the stochastic oscillator is starting to cross in the overbought area. I believe that most of this is a reaction to the US dollar getting beaten up in the Forex world, but quite frankly that only carries precious metals so far. Yes, it’s catalyst but we also need more underlying demand for precious metals.

Currently, what would be needed is some type of run to a safe haven asset, where gold really shines. I think this is just a continuation of the overall consolidation that we have seen, and that the $1300 level above should hold. If it doesn’t, obviously everything changes but in the meantime, I assume it’s more of the same, impulsive moves back and forth through consolidation. I suspect that the market will go looking towards the $1275 level with serious things calm down, as we have done several times before.

If we do break above $1300 on a daily close, then I think the market can go to the $1325 level next. However, we are going to need to build up a significant amount of momentum to do that, so I think it would take several attempts for the move to happen.

Gold Price Video 16.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement