Advertisement

Advertisement

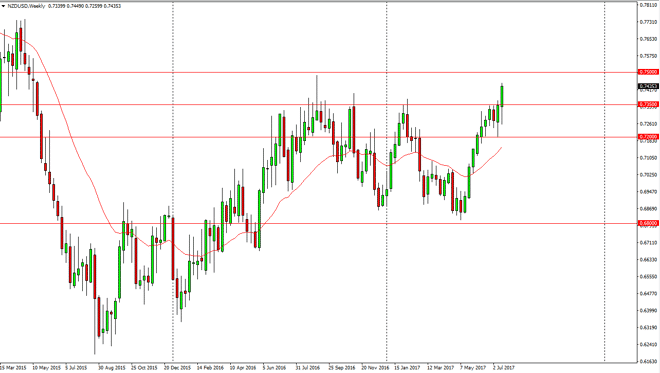

NZD/USD forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:40 GMT+00:00

The New Zealand dollar initially fell during the week but found enough support near the 0.7250 level to turn around and finally break out above the 0.7350

The New Zealand dollar initially fell during the week but found enough support near the 0.7250 level to turn around and finally break out above the 0.7350 handle. The 0.75 level above is the next target, and I believe that it is a substantial area that the markets will be paying attention to. I think that this market will continue to see quite a bit of volatility, but remember that the New Zealand dollars highly sensitive to risk appetite and quite frankly the overall “mood” of the market. With this being the case, I’m looking at pullbacks as buying opportunities as we have broken out, and I look at the 0.72 level as a bit of a “floor” in the market.

Buying the dips

I continue to buy the dips in this market, because quite frankly we have seen so much in the way of bullish pressure. I believe that the market continues to bet against the US dollar in the short term, so I think that we will continue to see the New Zealand dollar benefit as a result. Given enough time, I expect the 0.75 level above to be broken through, and that the buyers will come back into the market and become very aggressive. It is not until we break down below the 0.72 level that I would be a seller, and even then, I think the downside is probably limited to the 0.68 handle under that.

Pay attention to the CRB Index, as it gives you an idea as to how commodities are going overall, and that generally matches up quite well with what the New Zealand dollar does longer term. As it is so highly sensitive to agricultural commodities, it’s easier to follow the CRB in general than it is to follow each individual futures market.

NZD/USD Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement