Advertisement

Advertisement

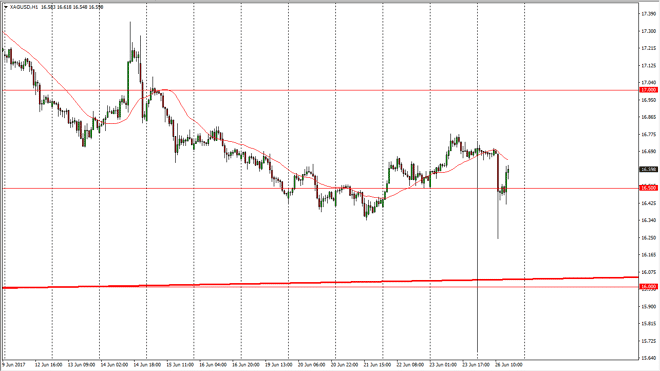

Silver Forecast June 27, 2017, Technical Analysis

Updated: Jun 27, 2017, 06:53 GMT+00:00

The Silver markets had a volatile session on Monday, as we initially went sideways and then fell significantly below the $16.50 level. However, we bounced

The Silver markets had a volatile session on Monday, as we initially went sideways and then fell significantly below the $16.50 level. However, we bounced as the Americans came on board, and this shows that there is a certain amount of support in the form of the $16.50 level. I believe that a break above the top of the range for the day should send this market towards the $17 level after that. A break above there should send this market much higher. There is also an uptrend line just below, and that should continue to offer support over the longer term. I believe that the market will of course be volatile as it typically is, but it seems like the buying pressure is starting to pick back up. I think the dips will offer short-term buying opportunities, and this gives us an opportunity to build a larger position.

The US dollar and its relation to Silver

I believe that if the US dollar falls a bit, that should also help Silver, not to mention the fact that it could get a bit of a safety bid with a lot of the central bank governors around the world speaking today. I favor the upside, but I would caution jumping into the market with both feet, perhaps building a larger position for a longer-term moved to the upside. I do have a long-term target of $20 for this market, but it’s going to take a lot of momentum and of course wherewithal for the market to reach that level. A breakdown below the $16 level would be very negative, and that could send this market down to the $15 level, however I would have to see a daily close below $16 to start selling.

SILVER Video 27.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement