Advertisement

Advertisement

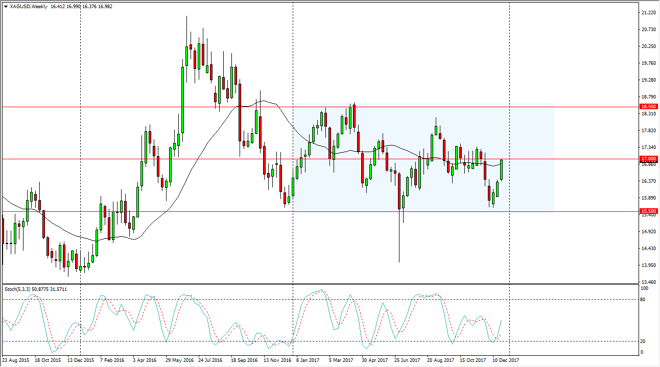

Silver Price forecast for the week of January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:07 GMT+00:00

Silver markets were bullish during the previous week, as we have bounced over the last couple of weeks from the bottom of the dearly range. We now find ourselves near perceived “fair value.”

The Silver markets have rallied over the last several weeks, and it looks likely that we are going to struggle here at the $17 level as it is the middle of the yearly range. $17 has cause both buying and selling, so I think that the next move might be difficult. If we were to break above the $17.30 level though, that would be bullish enough that I think we would go looking towards the top of the blue box on the chart, the $18.50 level. Otherwise, we could pull back a little bit, with the $15.50 level underneath offering massive support.

For what it’s worth, the US dollar has been falling significantly, so I think eventually this does help Silver go higher, and of course gold has broken the psychologically important $1300 level, also offering a bit of encouragement for silver traders. I think buying pullbacks will probably be the easiest way to trade this market, but off short-term charts. For those who are longer-term traders, you may be better off buying physical silver and simply holding onto it until we reach the $18.50 level. If you can’t do that, then perhaps considering the CFD market so that you can keep your position size small and then add as we move along is a nice alternative. Futures markets are probably going to be difficult for the longer-term trader, because we could swing quite drastically to the downside over the next couple of weeks, only to see the market break out and towards the top of the blue box.

SILVER Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement