Advertisement

Advertisement

Crude Oil Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:14 GMT+00:00

Crude oil markets broke out early during Friday trading, and what would have been very thin conditions. However, by the time the Americans came on board, the markets had cooled off and we have settled for the day.

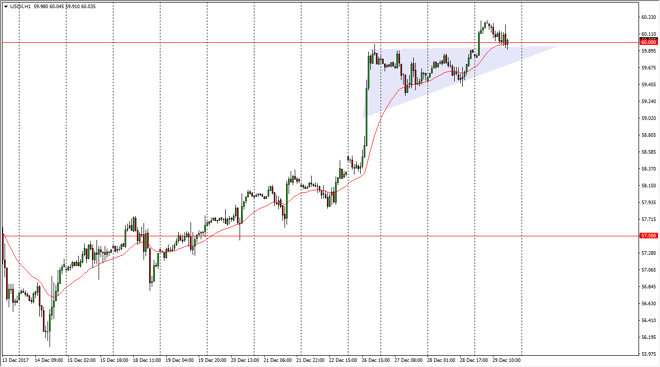

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session initially, but found Friday to be too insignificant to continue the movement. We are starting to hover around the $60 level, and I think this is probably where we are going to start looking for support. If we can break above the $60.30 level, the market should then be able to go to the $62.50 level over the longer term. I think pullbacks continue to be buying opportunities, and as you can see on the hourly chart, I have an ascending triangle drawn, and we have broken above it and we are starting to look like a classic breakout just waiting to happen.

Crude Oil Inventories Video 02.01.18

Brent

Brent pulled back slightly during the session, but there is a nice uptrend just below, and it should continue to offer support for the marketplace. I believe that we will probably go to the $67 level above, which offered resistance earlier last week. I think that a breakdown below the uptrend line sends this market down to the $65 level, which of course is a large, round, psychologically significant number. At that point, I think it’s only a matter of time before the buyers return. The $70 level above will be difficult, but reachable. If we were to break above that level, it would be a bit surprising that the market should continue like that. I believe that we will continue to see choppy trading conditions, but it certainly looks as if the buyers are starting to jump into the crude oil markets.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement