Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Index Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:27 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially drifted lower during Monday trading, reaching towards the 23,500 level to find buyers. We bounce from there to

Dow Jones 30

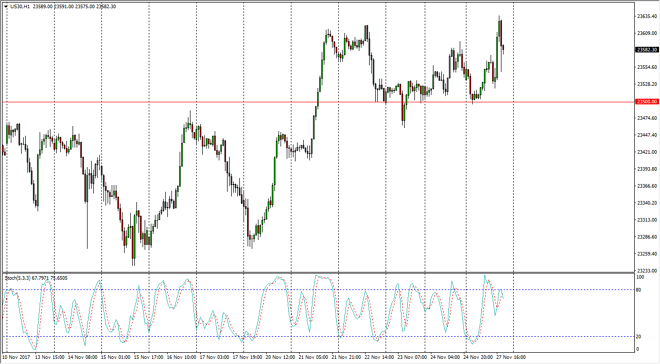

The Dow Jones 30 initially drifted lower during Monday trading, reaching towards the 23,500 level to find buyers. We bounce from there to reach towards the 23,635 handle, and then pull back again. However, every time we dip, the Dow Jones 30 seems to find buyers, as do most US stock indices. Algorithmic trading continues to lead the way, and I don’t think that this is a market you can sell. In fact, it looks to me like the 23,500 level is starting to offer a bit of a floor. I think that eventually we go looking towards the 25,000 level above, and although this market is overbought on longer-term charts, you certainly cannot step in front of this type of momentum as risk appetite continues to be strong.

Dow Jones 31 and NASDAQ Index Video 28.11.17

NASDAQ 100

The NASDAQ 100 of course has been bullish as well, showing signs of support at the 6400 level, an area that was massively resistive in the past. By pulling back yet again, and showing support yet again, it looks as if we are in a bit of a holding pattern, perhaps trying to build up the momentum necessary to reach towards the 6500 level above. I believe that is a psychologically important level that of course will attract a lot of attention, and be a juicy target for the bullish traders out there to take advantage of.

I look at the 6370 level as a bit of a floor currently, and that short-term traders continue to jump in based upon dips that offer value, in a market that I think almost must test the 6500 level above to answer a lot of questions. Longer-term, I don’t see why we wouldn’t continue to go higher, because quite frankly the machines have taken over.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement