Advertisement

Advertisement

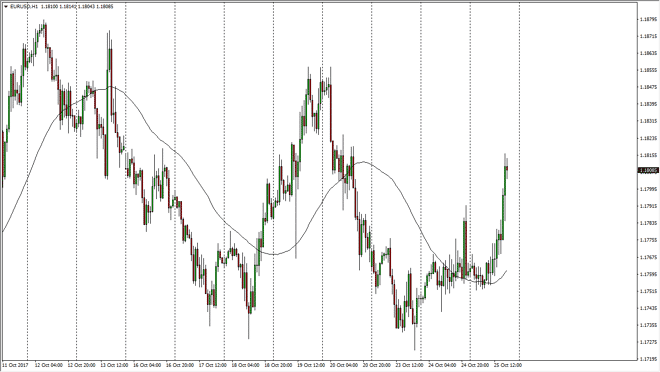

EUR/USD Forecast October 26, 2017, Technical Analysis

Updated: Oct 26, 2017, 04:38 GMT+00:00

The EUR/USD pair initially went sideways on Wednesday, but then reached above the 1.18 level. That’s a very bullish sign, and I think we are going to

The EUR/USD pair initially went sideways on Wednesday, but then reached above the 1.18 level. That’s a very bullish sign, and I think we are going to continue to go much higher, perhaps reaching towards the 1.1850 level, and then the 1.19 level. Longer-term, I believe that the market is probably going to the 1.20 level above, but if we break down below the 1.17 level, that would be a selling opportunity as the market would break down below the longer-term head and shoulders pattern that could be forming on the daily chart. However, it currently looks likely that the overall attitude of the market is changing to the upside again, so I’m a buyer of dips until we break down below the 1.17 level. If we were to break down below there, then I would become aggressively short. Until then, I suspect that these markets will offer short-term back or trading with a slightly upward tilt.

I suspect that the market is probably one you should trade small positions in, as there will be a lot of volatility and indecision in the market. Ultimately, I think that we are trying to decide whether the breakout of the previous consolidation on the daily chart matters, and if we can break above the 1.21 level, we should then go reaching towards the 1.25 handle after that as it is the longer-term target. However, the recent selloff has been very disruptive, and with the ECB having an interest rate decision and more importantly a press conference today, any signs of the bearishness out of Mario Draghi could send this market right back down. It is because of this I am staying out of the market for the next 24 hours or so, but if you feel that you need to stay in it, be very cautious.

Euro to Dollar Forecast Video 26.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement