Advertisement

Advertisement

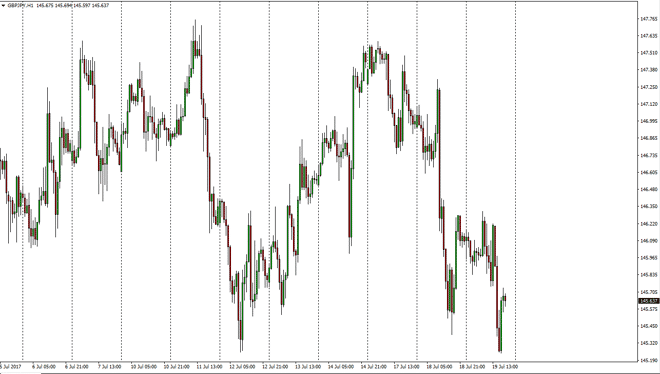

GBP/JPY Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:21 GMT+00:00

The British pound fell against the Japanese yen during the session on Wednesday, after initially grinding sideways near the 146 handle. We bounced just

The British pound fell against the Japanese yen during the session on Wednesday, after initially grinding sideways near the 146 handle. We bounced just above the 145 level, which is vital on the longer-term charts. Because of this, I think that we are going to have a difficult session or 2 coming. If we can break above the 146.50 level, then I feel the buyers will be much more comfortable adding to their positions. My base case is that we bounce, but I am the first to admit that the market could also breakdown. If we break down below the 145 handle, that is a very bad sign and should send this market much, much lower with one a target being at least 145.50 underneath.

Longer-term outlook

I believe that longer-term outlook of this pair is probably to the upside, so I am much more comfortable buying than I would be selling. With this in mind, I am waiting to see if we can break out to the upside, or at least get some type of nice bounce to take advantage of. Longer-term, I anticipate that the market will return to the 147.50 level, which offered significant resistance in the past. Volatility is a mainstay in this market, so it’s not a big surprise that we found some during the day. If you are careful, you can probably add to your positions as they work out in your favor in small incremental moves. Remember, they call this pair “The Dragon” for reason.

GBP/JPY Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement