Advertisement

Advertisement

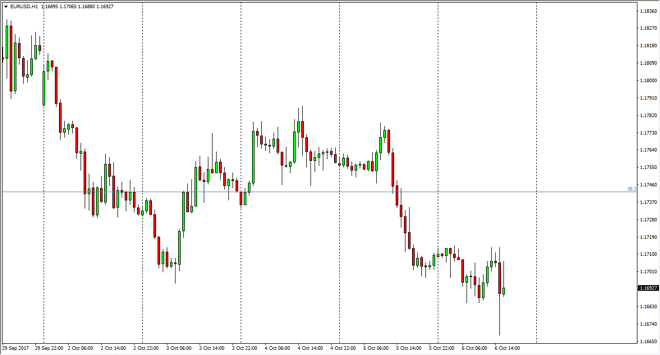

EUR/USD Forecast October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 07:00 GMT+00:00

The EUR/USD pair showed extreme amounts of volatility early in the session on Thursday, but after the jobs number came out of America, we shot higher,

The EUR/USD pair showed extreme amounts of volatility early in the session on Thursday, but after the jobs number came out of America, we shot higher, reaching towards the 1.1750 level. At this point, I think that the 1.17 level underneath is going to be a bit of a floor, and I think that we may continue the longer-term uptrend. However, if we did breakdown, I believe that the market will then reach towards the 1.15 level underneath. That was the scene of a major breakout, so would make sense to retest that area, but it’s not a given necessarily. I think that the market will eventually go to the 1.25 handle above, based upon the break out and of measuring the potential move.

Ultimately, I do think that we get to the upside and towards the 1.25 handle, but it is going to be very noisy. When I look at the hourly chart, it looks likely that the buyers are coming in on dips, as the impulse to the upside has been followed up by more buying. I think that the 1.18 level will be somewhat resistive, but eventually will break above there and test the 1.20 level which caused quite a bit of resistance in the past. I think we are going to continue to see a lot of choppiness in this market, with an upward bias overall. Because of that, I think that the overall proclivity of trading should be to the upside but I also recognize that we should probably take profits rather quickly. I do recognize that the 1.20 level above is going to be massive as far as resistance goes, but if we can finally clear that level, we could go much higher and recognize more of a “buy-and-hold” attitude in the market, offering opportunities to add to an already winning position.

EUR/USD Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement